As a person who works in the financial sector (and runs a personal finance blog), one question I hear often from friends and family is “How can I maximize my employer’s retirement plan contribution match?”

It’s a good question, a great one really, as the contribution match is essentially free money that can significantly boost your retirement savings.

In this article, I want to share some strategies and tips for maximizing your employer’s retirement plan contribution match.

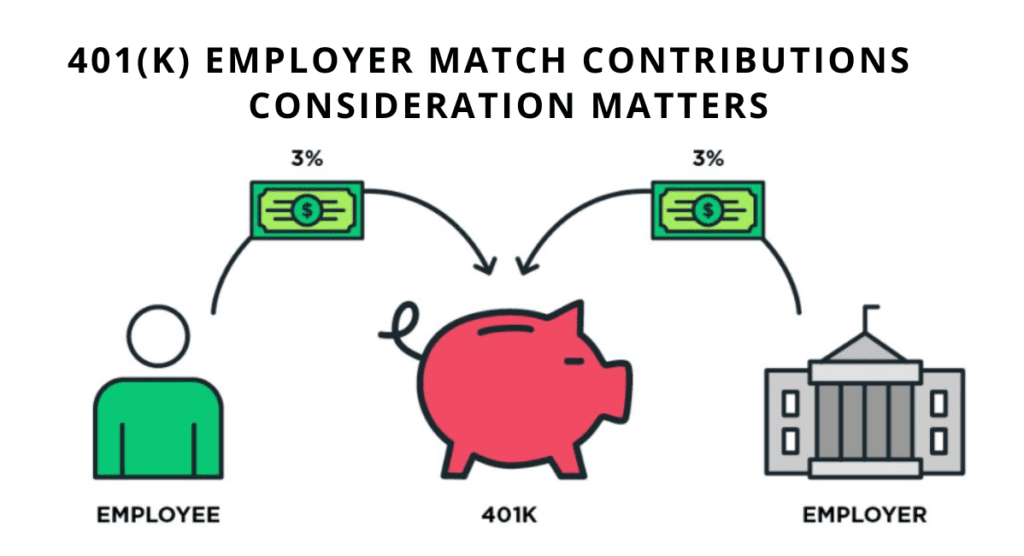

What is an employer’s retirement plan contribution match?

An employer’s retirement plan contribution match is a benefit offered by many companies to encourage and help employees to save for retirement.

Essentially, the employer will match a certain percentage of the employee’s contribution to the retirement plan, up to a certain amount.

For example: Your employer may offer a 50% match on the first 6% of the employee’s salary that is contributed to the retirement plan. This means that if the employee contributes 6% of their salary, the employer will also contribute an additional 3% (half of the employee’s contribution).

Why is it important to maximize your employer’s retirement plan contribution match?

Free Money

Maximizing your employer’s retirement plan contribution match is critically important for a number of reasons. First and foremost, it’s free money!

The employer’s contribution is essentially an additional bonus on top of your salary, and it can add up significantly over time.

For example: Continuing from our previous example, let’s assume you are earning a salary of $50,000 per year and your employer offers a 50% match on the first 6% of your salary.

That’s an additional $1,500 per year (3% of your salary) that you are receiving for free!

Retire Faster

Another reason to maximize your employer’s retirement plan contribution match is that it can help you reach your retirement savings goals faster.

By contributing the maximum amount that your employer will match, you are essentially “doubling” your savings efforts. This can make a big difference in the long run, as compound interest and time are crucial factors in building a successful retirement portfolio.

Tax Benefits

Finally, maximizing your employer’s retirement plan contribution match can help you take advantage of the tax benefits of retirement saving.

Contributions to a 401(k) or similar retirement plan are tax-deferred, meaning you won’t have to pay taxes on the money you contribute until you withdraw it in retirement. This can help you save on your current tax bill and potentially lower your overall tax burden.

How do you maximize your employer’s retirement plan contribution match?

This is not rocket science, as you will see it is pretty simple to maximize your employer’s match. Here’s how:

1. Contribute at least the amount that your employer will match. This is the most obvious and straightforward way to maximize your employer’s contribution match.

If your employer offers a 50% match on the first 6% of your salary, make sure you are contributing at least 6% of your salary to the retirement plan. This will ensure that you are receiving the maximum employer match.

2. Increase your contribution over time. If you are just starting out in your career, you may not have the financial means to contribute the maximum amount that your employer will match right away.

That’s okay – start by contributing at least the amount that your employer will match, and then try to increase your contribution over time as your financial situation allows.

By increasing your contribution by even just a small amount each year, you can take advantage of compound interest and potentially build a larger retirement savings over time.

3. Take advantage of salary increases and bonuses. If you receive a raise or bonus at work, consider increasing your retirement plan contribution to take advantage of the extra income.

This can be a great opportunity to boost your retirement savings and maximize your employer’s contribution match.

4. Consider a backdoor IRA contribution. If you are unable to contribute the maximum amount to your employer’s retirement plan due to income or contribution limits, you may be able to make a “backdoor” contribution to an individual retirement account (IRA).

A backdoor IRA contribution allows you to make a contribution to an IRA even if you are already contributing to an employer-sponsored retirement plan. This can be a good way to save additional money for retirement and take advantage of the tax benefits of an IRA.

5. Don’t forget about other retirement savings options. In addition to your employer’s retirement plan, you may have other retirement savings options available to you, such as a solo 401(k) or a traditional or Roth IRA.

While these options may not offer an employer match, they can still be a good way to save additional money for retirement and take advantage of tax benefits.

The Power of Compound Interest: Why It’s Never Too Early to Start Saving for Retirement

Oh, Compound Interest, what I consider the 8th wonder of the world.

Compound interest is a powerful force in the world of personal finance, and it can play a significant role in your retirement savings.

Understanding how compound interest works and how to take advantage of it can help you build a larger retirement nest egg over time.

I recommend playing around with this compound interest calculator to see the potential.

What is compound interest and how does it work?

Compound interest is the interest that is earned on both the principal amount of an investment and the accumulated interest from previous periods. In other words, it is the interest that is earned on top of interest.

Here’s an example to illustrate how compound interest works:

Let’s say you invest $1,000 in a savings account that earns 5% interest per year. After the first year, you will have earned $50 in interest (5% of $1,000 is $50).

If you leave the $1,050 (the original $1,000 plus the $50 in interest) in the account for another year, you will earn interest on the $1,050. In this case, you would earn an additional $52.50 in interest (5% of $1,050 is $52.50).

As you can see, the amount of interest you earn increases each year due to the power of compound interest. This is because the interest you earn is added to the principal amount of your investment, and you then earn interest on the larger balance.

The benefits of starting to save for retirement as early as possible

Starting to save for retirement as early as possible can help you take full advantage of the power of compound interest.

The earlier you start saving, the more time you have for your money to grow and earn compound interest.

For example: Let’s say you start saving for retirement at age 25 and contribute $5,000 per year to your retirement account until you retire at age 65.

If your retirement account earns an average annual return of 8%, you will have around $1.4 million in your account by the time you retire.

Now, let’s say you don’t start saving for retirement until age 35. If you contribute the same amount per year as the person who started at age 25, but you only have 30 years to save instead of 40, your account will only have around $840,000 at retirement (assuming the same 8% annual return).

As you can see, starting to save for retirement just 10 years later has a significant impact on the size of your retirement nest egg.

This is why it’s important to start saving as early as possible – even if you can only afford to contribute a small amount at first.

How compound interest can help you build a larger retirement savings over time

In addition to starting to save for retirement as early as possible, maximizing your contributions to your retirement account can also help you take full advantage of compound interest. The more you contribute to your retirement account, the more interest you will earn, which can help your account grow faster.

For example: Let’s say you start saving for retirement at age 25 and contribute $5,000 per year to your retirement account until you retire at age 65. If your account earns an average annual return of 8%, you will have around $1.4 million in your account by the time you retire.

Now, let’s say you increase your annual contribution to $10,000 per year. In this case, you will have around $2.7 million in your account at retirement, even though you are only contributing twice as much each year. This is because the additional contributions allow your account to earn more interest, which compounds over time.

As you can see, compound interest can be a powerful tool for building a larger retirement nest egg. By starting to save as early as possible and maximizing your contributions, you can take full advantage of this powerful force and build a secure financial foundation for your future.

Frequently Asked Questions:

Can I contribute to both an employer-sponsored retirement plan and an IRA?

Yes, in most cases you can contribute to both an employer-sponsored retirement plan and an IRA in the same year. However, there are income and contribution limits that may affect your ability to contribute to an IRA.

It’s a good idea to consult with a financial planner or tax professional to determine the best retirement savings strategy for your individual situation.

Can I change my retirement plan contribution amount at any time?

In most cases, you can change your retirement plan contribution amount at any time. However, it’s a good idea to check with your employer or the plan administrator to confirm this and to understand any deadlines or restrictions that may apply.

What if I change jobs or leave my employer?

If you change jobs or leave your employer, you have several options for your retirement savings. You can leave the money in your current employer’s plan, if allowed, or you can roll it over to a new employer’s plan or to an IRA.

Rolling over your retirement savings to a new employer’s plan or an IRA can allow you to continue saving for retirement and potentially take advantage of additional investment options and tax benefits. It’s important to carefully consider your options and consult with a financial planner or tax professional before making a decision.

Conclusion:

Maximizing your employer’s retirement plan contribution match can be a smart way to boost your retirement savings and take advantage of free money.

By contributing at least, the amount that your employer will match, increasing your contribution over time, and taking advantage of salary increases and bonuses, you can make the most of this valuable benefit. And if you are unable to contribute the maximum amount to your employer’s plan, consider a backdoor IRA contribution or other retirement savings options to supplement your savings.

With some careful planning and strategy, you can take control of your retirement future and build a secure financial foundation for yourself.