Are you interested in investing but don’t have a lot of money to work with? Don’t let a small budget hold you back! With a little bit of planning and patience, it is possible to start building a portfolio even with a small amount of money.

In this ultimate beginner’s guide to investing, we’ll show you how to turn your spare change into a fortune with five easy steps. From micro-investing platforms and low-minimum mutual funds to the best strategies for different life stages, we’ve got you covered.

So, if you’re ready to start investing and building your wealth, keep reading to learn how to get started with a small amount of money.

Start by Setting Financial Goals

Before you start investing, it’s important to know what you’re saving for.

Do you want to buy a house, pay for your child’s education, or simply build wealth for the future? By setting clear financial goals, you can help ensure that your investments are aligned with your long-term objectives.

There are several factors to consider when setting financial goals. First, consider your time horizon. How long do you have until you need to reach your goal? For example, if you’re saving for retirement, you might have several decades to invest, which allows you to take on more risk in exchange for the potential for higher returns.

On the other hand, if you’re saving for a down payment on a house, you might have a shorter time horizon, which might require a more conservative approach.

Another factor to consider is your risk tolerance, or the amount of financial risk you’re comfortable taking on. Some people may be willing to accept higher levels of risk in exchange for the potential for higher returns, while others may prefer a more conservative approach. Understanding your risk tolerance can help you choose investments that are appropriate for your financial situation and goals.

Finally, consider your financial resources. How much money do you have to invest? Do you have any debts or other financial obligations that might impact your ability to invest? By taking a realistic look at your financial situation, you can better understand what you can afford to invest and how to allocate your investments to best meet your goals.

Once you’ve set your financial goals and considered your time horizon, risk tolerance, and financial resources, you’re ready to start thinking about how to invest your money. In the next step, we’ll explore some options for starting to invest with a small amount of money.

Determine Your Risk Tolerance

Understanding your risk tolerance is an important step in the investing process, as it can help you choose investments that are appropriate for your financial situation and goals. But how do you determine your risk tolerance?

There are several factors that can influence your risk tolerance, including your age, financial situation, and personality. For example, if you’re younger and have a longer time horizon, you may be able to afford to take on more risk in exchange for the potential for higher returns. On the other hand, if you’re closer to retirement or have other financial obligations, you might prefer a more conservative approach.

Your personality can also play a role in your risk tolerance. Some people are naturally more risk-averse, while others are more willing to take on risk in pursuit of higher returns. It’s important to understand your own comfort level with volatility and consider whether you’re more likely to panic in a downturn or stay the course.

There are also online risk tolerance quizzes and tools that can help you assess your risk tolerance. While these quizzes can be helpful, it’s important to keep in mind that they are just a starting point and may not take into account all of the factors that can influence your risk tolerance. It’s always a good idea to consult with a financial advisor or professional to get a more accurate assessment of your risk tolerance.

Consider micro-investing platforms

One way to start investing with a small amount of money is by using a micro-investing platform, such as Acorns or Stash. These platforms allow you to invest small amounts of money, often as little as $5 or $10 at a time, by rounding up your spare change or automatically transferring small amounts from your bank account.

Micro-investing platforms typically offer a range of investment options, including mutual funds and exchange-traded funds (ETFs), and often have low minimum investment requirements. For example, with Acorns, you can start investing with as little as $5, and the platform will automatically invest your spare change in a portfolio of ETFs based on your risk tolerance and financial goals.

Our Top Investing Platforms that Allow Micro-Investing

- Acorns: This app rounds up your purchases to the nearest dollar and invests the spare change. It also offers a variety of investment portfolios to choose from and allows you to invest in fractional shares of stocks and ETFs.

- Stash: This app allows you to invest with as little as $1 and offers fractional shares of a variety of stocks and ETFs. It also provides educational resources to help you learn about investing.

- Robinhood: This popular trading app allows you to buy and sell stocks and ETFs, including fractional shares. It has a user-friendly interface and does not charge commissions on trades.

- Betterment: This robo-advisor offers a range of investment portfolios, including fractional shares, and provides personalized investment recommendations based on your goals and risk tolerance.

- Wealthfront: This robo-advisor offers a variety of investment portfolios, including fractional shares, and uses advanced technology to optimize your portfolio and minimize taxes. It also offers financial planning tools to help you manage your overall financial situation.

You can find a more in-depth analysis here in our article of the top investment apps for beginners.

One of the benefits of micro-investing is that it allows you to start investing with a small amount of money and build up your portfolio over time.

It’s a good option for beginners who might not have a lot of money to invest upfront, or for those who want to test out the waters before committing to a larger investment.

However, it’s important to keep in mind that micro-investing platforms often charge fees, which can eat into your returns. For example, Acorns charges a fee of $1 per month for accounts with a balance of less than $5,000, or 0.25% per year for accounts with a balance of $5,000 or more. These fees can add up over time, so it’s important to consider whether the convenience of micro-investing is worth the cost.

Look for low-minimum mutual funds

Another option for starting to invest with a small amount of money is by looking for mutual funds with low minimum investments. Mutual funds are a type of investment that pools together money from many investors and uses it to buy a diversified portfolio of stocks, bonds, or other securities.

By investing in a mutual fund, you can get exposure to a wide range of assets, which can help reduce risk and increase your chances of earning a positive return.

A great place to find solid low fee mutual funds is with Vanguard. While Vanguard is typically better for the more seasoned investors, it is still great for beginners as well.

Many mutual funds have minimum investment requirements, but you can often find options with low minimums, such as $500 or $1,000. Some mutual funds even have no minimum investment requirement, which means you can start investing with any amount of money.

When looking for a mutual fund, it’s important to consider the expense ratio, which is the percentage of your assets that the fund charges in fees each year. A higher expense ratio can eat into your returns, so it’s generally a good idea to look for funds with low expense ratios. You should also consider the fund’s track record and diversification, as well as whether it aligns with your financial goals and risk tolerance.

Use dollar-cost averaging

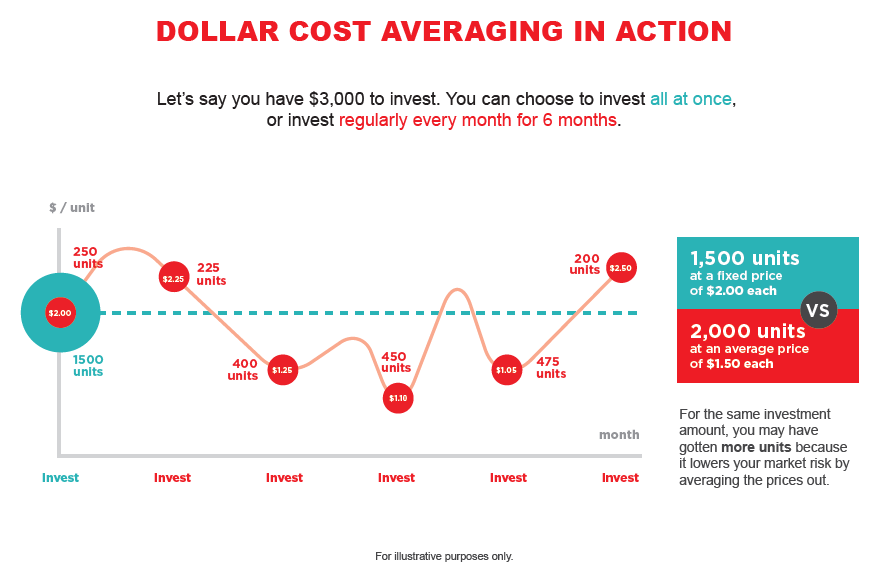

Dollar-cost averaging is a technique that involves investing a fixed amount of money at regular intervals, regardless of the current market conditions. By investing a set amount of money on a regular basis, you can help smooth out the ups and downs of the market and potentially reduce your risk.

For example, let’s say you have $50 per month to invest, and you decide to invest in a stock that is currently trading for $50 per share. If you invest your entire $50 at once, you’ll only be able to buy one share. However, if you use dollar-cost averaging and invest $50 every month, you’ll be able to buy more shares over time, which could potentially lead to a higher return on your investment.

Dollar-cost averaging can be a good strategy for beginners who might not have a lot of money to invest upfront, as it allows you to start building a portfolio slowly and steadily over time.

It can also help reduce the risk of investing all of your money at once, as you’re investing a fixed amount on a regular basis rather than trying to time the market.

To implement dollar-cost averaging, you can set up automatic investments with a brokerage or investment platform, or simply make regular contributions to your investment account. Just be sure to choose a fixed amount to invest and stick to your plan, even if the market is volatile.

Educate Yourself

As with any financial decision, it’s important to do your research and educate yourself before you start investing. Consider reading books or articles about investing, attending workshops or seminars, or seeking the guidance of a financial advisor.

There are also many online resources available, such as investing podcasts, blogs (like this one), and forums, where you can learn about different investment strategies and get advice from experienced investors.

Be Patient

Investing is a long-term game, and it’s important to be patient and stay the course. Don’t get discouraged if your investments don’t perform as well as you’d like in the short term. Instead, focus on your long-term financial goals and continue to make regular contributions to your portfolio.

It’s also important to regularly review your investments and make any necessary adjustments to ensure that your portfolio remains aligned with your financial goals.

The Start to Your Investing Journey

By following these tips and strategies, you can start building a solid foundation for your investment portfolio, even if you have a small amount of money to work with.

Remember to set clear financial goals, understand your risk tolerance, and be patient as you build your portfolio over time. With a little bit of planning and discipline, you can achieve your financial goals and build a secure financial future.