Creating a budget can seem like a daunting task, but it doesn’t have to be. The 50/30/20 rule is a simple, yet effective, budgeting strategy that can help you create a balanced budget, pay off debt, and save money. In this article, I will explain the rule, how it works, and how to implement it in your own budget.

What is the 50/30/20 rule?

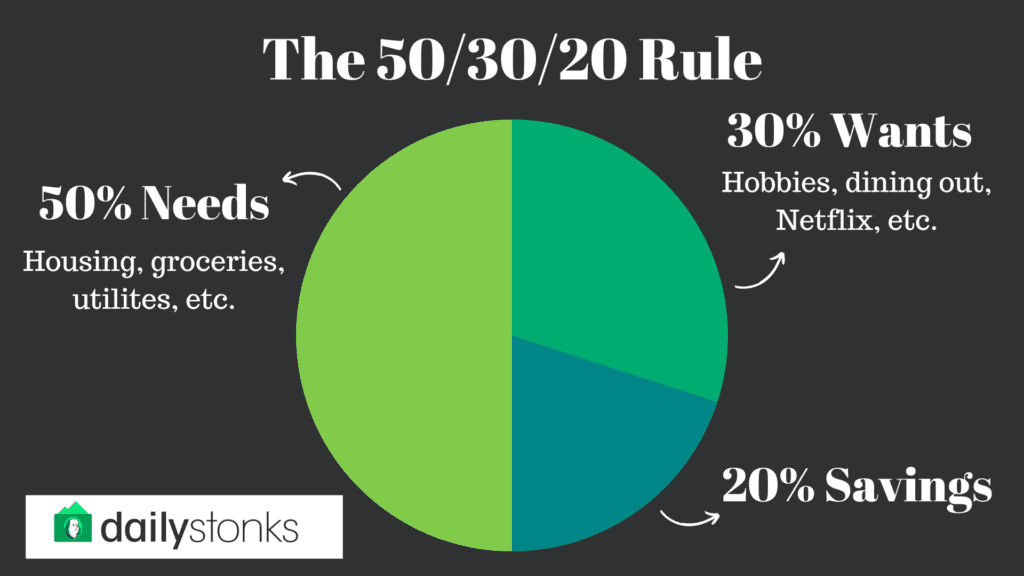

The 50/30/20 rule is a simple, yet effective, budgeting strategy that can help you create a balanced budget, pay off debt, and save money. The rule states that 50% of your income should go towards necessities, 30% towards wants, and 20% towards savings and debt repayment. By allocating your income in this way, you can create a balanced budget that allows you to meet your basic needs, enjoy some of life’s luxuries, and make progress on your financial goals.

Benefits of using the 50/30/20 rule

The 50/30/20 rule is a simple and flexible budgeting strategy that can help you create a balanced budget and achieve your financial goals. By allocating your income in this way, you can ensure that you’re meeting your basic needs, enjoying some of life’s luxuries, and saving money and paying off debt.

Importance of creating a budget and sticking to it

Creating a budget and sticking to it is essential for achieving your financial goals. A budget allows you to keep track of your income and expenses, and make sure you’re making progress on your financial goals.

By creating a budget and sticking to it, you can avoid overspending and ensure that you’re making the most of your money.

Breakdown of the 50/30/20 rule and how it’s applied

The 50/30/20 rule is applied as follows:

- 50% of your income should go towards necessities, such as rent or mortgage, utilities, food, transportation, and insurance.

- 30% of your income should go towards wants, such as dining out, entertainment, travel, and shopping.

- 20% of your income should go towards savings and debt repayment, such as emergency savings, retirement savings, and paying off credit card debt or student loans.

50/30/20 categories and how they fit into the rule

- Necessities: These are the expenses that are essential for maintaining your basic standard of living, such as housing, food, and transportation. These expenses should take up no more than 50% of your income.

- Wants: These are the expenses that are not essential, but that make life more enjoyable, such as dining out, entertainment, and shopping. These expenses should take up no more than 30% of your income.

- Savings and debt repayment: These are the expenses that help you achieve your financial goals, such as saving for retirement or paying off debt. These expenses should take up no more than 20% of your income.

Flexibility and adjusting the rule to fit individual needs

It’s important to note that the 50/30/20 rule is a general guideline and not a one-size-fits-all solution. Your individual needs and financial situation may vary, and it’s important to adjust the rule to fit your unique circumstances.

For example, if you live in an expensive city where housing takes up a larger portion of your income, you may need to adjust the percentages accordingly.

Additionally, if you have a lot of high-interest debt, you may want to allocate more towards debt repayment and less towards wants. The key is to find a balance that works for you and your financial goals.

Implementing the 50/30/20 Rule

Steps for creating a budget using the 50/30/20 rule

- Determine your monthly income: The first step in creating a budget using the 50/30/20 rule is to determine your monthly income. This includes all sources of income, such as salary, bonuses, and investments.

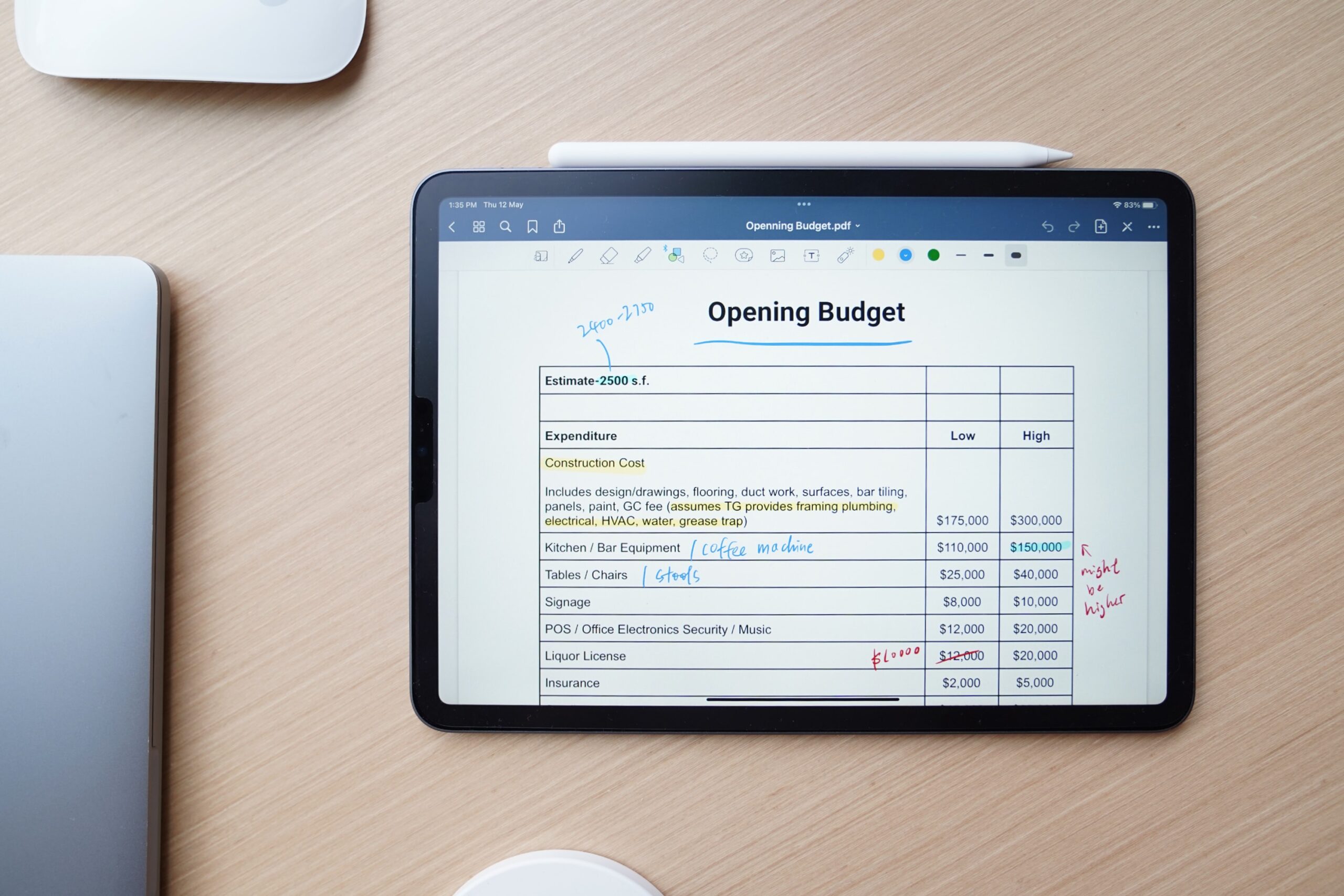

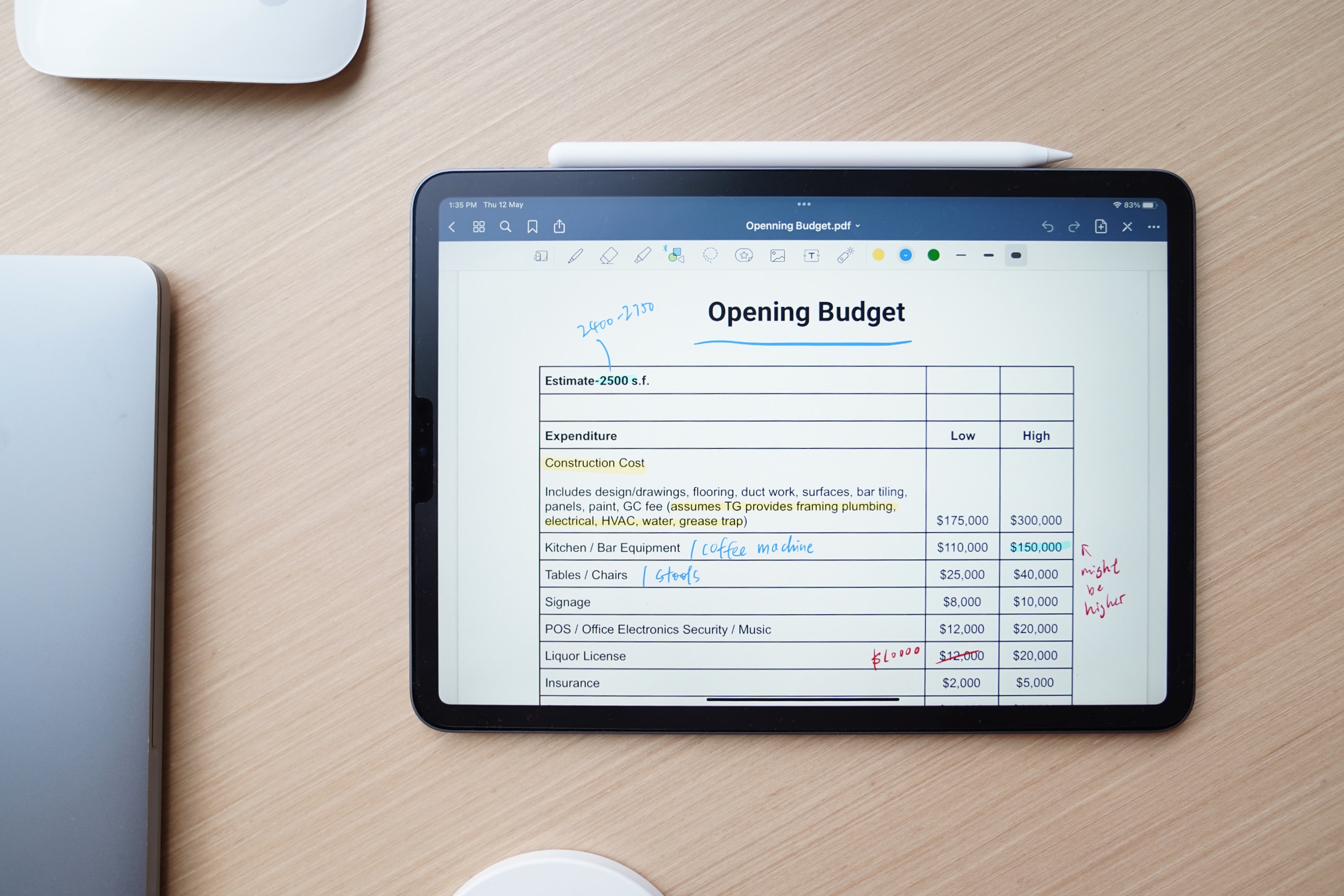

- List your expenses: The next step is to list all of your expenses, including both fixed and variable expenses. Fixed expenses are expenses that stay the same every month, such as rent or mortgage and insurance. Variable expenses are expenses that change from month to month, such as groceries and entertainment.

- Calculate the percentage of your income that goes towards each category: Once you have your income and expenses listed, calculate the percentage of your income that goes towards necessities, wants, and savings and debt repayment. You can use a budgeting app or spreadsheet to help with this.

- Adjust your budget: If the percentages don’t match up with the 50/30/20 rule, you’ll need to make adjustments. This may mean cutting back on wants or increasing your income.

Tips for tracking expenses and sticking to the budget

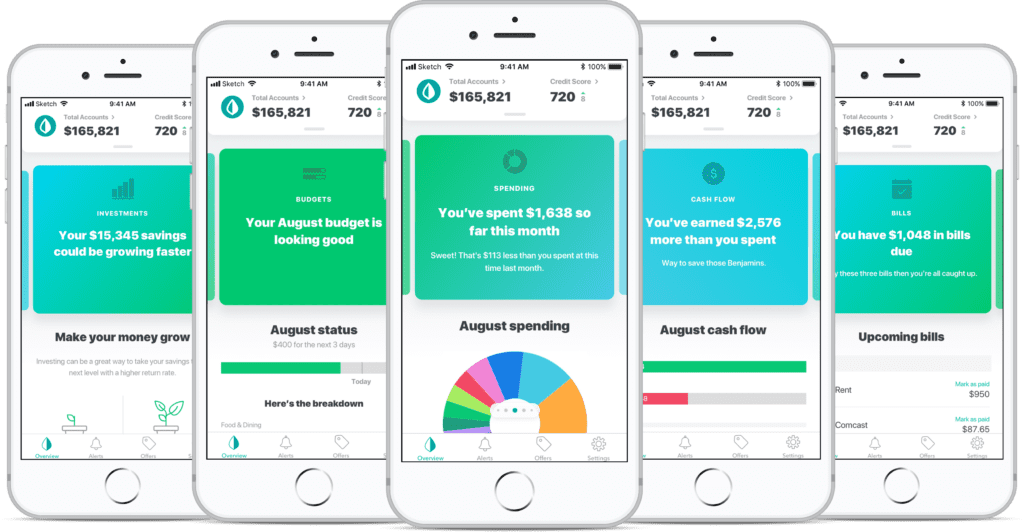

1. Use budgeting apps or spreadsheets:

Budgeting apps or spreadsheets can be a great way to keep track of your income and expenses. They can also help you see where you’re overspending and make adjustments to your budget. Some of my favorite budgeting apps can be found here.

If you have not used one before, I would say my favorite overall budgeting app is Mint.

2. Be mindful of impulse spending:

Impulse spending can be one of the biggest obstacles to sticking to a budget. To avoid impulse spending, make a list of what you need before you go shopping and stick to it.

3. Set reminders:

Set reminders for yourself to check in on your budget and see where you stand. You can set reminders on your phone or calendar to check in on your budget every week or month.

Strategies for paying off debt and saving money

1. Prioritize high-interest debt:

If you have high-interest debt, such as credit card debt, it’s important to pay it off as soon as possible. By prioritizing high-interest debt, you can save money on interest charges and become debt-free faster.

2. Automate your savings:

Setting up automatic savings can help you save money without even thinking about it. You can set up automatic transfers to your savings account or to a specific investment account.

3. Create a savings plan:

Creating a savings plan can help you stay on track and reach your financial goals. This can include setting a specific savings goal, such as a down payment on a house or a certain amount for retirement and determining a specific timeline for achieving that goal.

Common challenges faced when implementing the 50/30/20 rule

Difficulty sticking to the budget:

One of the most common challenges is sticking to the budget. This can be due to overspending on wants or unexpected expenses popping up.

Solution: Be realistic! When creating your budget, be realistic about your income and expenses. It’s important to be honest with yourself about what you can afford and what you can’t.

Difficulty increasing income:

Another challenge can be increasing your income to match the 50/30/20 rule. This can be due to a lack of job opportunities or difficulty in finding a higher paying job.

Solution: Make adjustments! If you find that you’re having difficulty sticking to the budget, make adjustments. You may need to cut back on wants or increase your income.

Difficulty paying off debt:

Paying off debt can also be a challenge, especially with high-interest rates.

Solution: Prioritize! Prioritize paying off high-interest debt and saving for your financial goals.

Importance of consistency and patience

Creating a budget and sticking to it requires consistency and patience. It may take some time to see results, but by staying consistent and making adjustments, when necessary, you can create a balanced budget and achieve your financial goals.

Consistent budgeting is essential for achieving your financial goals. By taking the time to understand the 50/30/20 rule and implement it in your own budget, you can gain control of your finances and make progress towards your financial goals.

It’s important to remember that the 50/30/20 rule is a general guideline and not a one-size-fits-all solution. Your individual needs and financial situation may vary, and it’s important to adjust the rule to fit your unique circumstances. The key is to find a balance that works for you and your financial goals.

50/30/20 Rule FAQ

Q: Can I adjust the percentages of the 50/30/20 rule to fit my individual needs?

A: Yes, the 50/30/20 rule is a general guideline and not a one-size-fits-all solution. Your individual needs and financial situation may vary, and it’s important to adjust the percentages to fit your unique circumstances. The key is to find a balance that works for you and your financial goals.

Q: How can I track my expenses and stick to my budget?

A: You can use budgeting apps or spreadsheets to track your expenses and help you stick to your budget. It’s also important to be mindful of impulse spending and set reminders for yourself to check in on your budget regularly.

Q: What should I do if I have high-interest debt?

A: If you have high-interest debt, it’s important to prioritize paying it off as soon as possible. You can do this by allocating more of your income towards debt repayment and making extra payments when possible.

Q: How can I increase my income to match the 50/30/20 rule?

A: To increase your income, you can look for higher paying job opportunities, start a side hustle, or negotiate a raise with your current employer.

Q: How long will it take to see results from following the 50/30/20 rule?

A: It may take some time to see results, but by staying consistent and making adjustments, when necessary, you can create a balanced budget and achieve your financial goals. It’s important to be patient and stay committed to the process.