If you have found your way to this article, it does not matter if you are a beginner or seasoned investor, if you have $100, or $1 million it can be overwhelming to navigate the world of investing and make informed financial decisions.

Something that helped me aside from diving into research online, or through my education, I have always found comfort in books. That’s where investing books can come in handy.

Not only do they provide valuable information and insights, but they can also serve as a source of inspiration and motivation to help you reach your financial goals.

I know this firsthand as throughout my investing journey I have read an unbelievable amount of investing books.

While not all of these books made me a millionaire (well none of them did technically), many of them have helped me to better understand the markets and different investing strategies. While others have sparked new ideas and helped me to stay focused and disciplined in my approach to investing.

If you are new to investing, consider checking out my favorite investing apps for beginners.

Why these books?

In this article, I want to share with you some of the investing books that have had the biggest impact on my own journey as an investor and why I believe they can be beneficial for both beginners and experienced investors alike.

Whether you are just starting out or looking to take your investing to the next level, these books offer valuable insights and strategies that can help you to succeed.

Before getting into the list of books, I want to provide you with some tips on how to get the most out of these books, including how to choose which books to read and how to apply the principles and strategies learned from them to your own investing approach.

Get the most out of these books

Here are a few tips on how to get the most out of investing books and apply what you learn to your own investing approach:

Choose books that align with your investing goals and interests:

There are many investing books out there, so it’s important to choose ones that are relevant to your own financial goals and interests.

For example: If you are interested in value investing, you might choose books that focus on that strategy, such as “The Intelligent Investor” or “The Little Book That Still Beats the Market” by Joel Greenblatt.

Take notes and highlight key points:

As you read, make a habit of taking notes and highlighting key points. This will help you to retain the information and make it easier to refer back to later.

You might also consider creating a summary of each book to help you to better understand and remember the main points. Though, this may not be right for everyone.

Reflect on how the information applies to your own situation:

As you read, take the time to reflect on how the information applies to your own financial situation.

Ask yourself questions such as “How can I use this information to make better investment decisions?” or “How does this fit in with my own financial goals and plans?”

Experiment with different strategies and approaches:

While it’s important to learn from the experts, it’s also important to remember that investing is a personal journey and what works for one person may not work for another.

Don’t be afraid to experiment with different strategies and approaches to find what works best for you.

Stay up to date:

Investing is a constantly evolving field, so it’s important to stay up to date with new ideas and developments. Consider subscribing to investing blogs or newsletters or follow investing experts on social media to stay informed.

Ok, now that you’re all caught up on how to actually gain value from these books, let’s get into the list.

My Top 5 Investing Books for Beginners

1. “The Intelligent Investor” by Benjamin Graham

In “The Intelligent Investor,” Benjamin Graham teaches readers the principles of value investing, which involves looking for undervalued companies with strong fundamentals and holding onto them for the long term.

Graham emphasizes the importance of having a well-thought-out investment plan and following it through market ups and downs. He also stresses the importance of maintaining a margin of safety, which means buying assets at a discount to their intrinsic value to protect against potential losses.

One of the key takeaways from the book is the concept of Mr. Market, an allegorical figure who represents the stock market and its fluctuations. Graham advises readers to view Mr. Market as a helpful, but sometimes irrational, business partner and to only buy or sell based on the intrinsic (actual) value of a company, rather than its market price.

What I learned from this book

This book, considered by many to be the “bible” of value investing, helped me to understand the principles of value investing and how to analyze a company’s financial statements to determine its intrinsic value.

I have applied these principles to my own investments, and it has helped me to make more informed and disciplined investment decisions.

Overall, “The Intelligent Investor” is an essential read for anyone looking to build a long-term investment portfolio and is considered one of the most influential books on investing of all time. If you are interested in reading, you can grab it here.

2. “Rich Dad Poor Dad” by Robert Kiyosaki

In “Rich Dad Poor Dad,” Robert Kiyosaki presents his personal story of growing up with two fathers: his biological father, a well-educated but financially struggling schoolteacher, and his best friend’s father, a self-made millionaire. Through his experience with both fathers, Kiyosaki learned the importance of financial literacy and the power of entrepreneurship.

One of the key themes of the book is the difference between working for money and having money work for you. Kiyosaki encourages readers to shift their mindset from traditional employment to building passive income streams through investments, real estate, and other assets. He also stresses the importance of taking calculated risks and learning from failures.

What I learned from this book

This book, which focuses on the importance of financial education and entrepreneurship, inspired me to think outside the box and consider alternative ways of building wealth beyond traditional employment (Hence why I started this blog).

It also helped me to understand the importance of asset allocation and the difference between “good” and “bad” debt.

Overall, “Rich Dad Poor Dad” is a thought-provoking and inspiring read that encourages readers to think differently about their finances and pursue their own path to financial freedom. Does this book interest you, if so, you can find it here.

3. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

This may be my favorite book on this list, purely due to the principles (not just investing) that are emphasized throughout the book. “The Millionaire Next Door” presents the results of their extensive research on the habits and characteristics of self-made millionaires.

Based on their findings, the authors conclude that the stereotype of the flashy, high-spending millionaire is largely a myth and that most millionaires are, in fact, ordinary people who have built their wealth through consistent saving and investing.

One of the key takeaways from the book is the importance of living below your means and avoiding consumer debt. The authors also emphasize the importance of setting financial goals, building a diversified portfolio, and seeking out opportunities for passive income.

What I learned from this book

This book, which explores the characteristics and behaviors of wealthy individuals, helped me to understand the importance of saving and investing for the long-term. It also challenged some of my assumptions about what it means to be wealthy and helped me to redefine my own financial goals.

Overall, “The Millionaire Next Door” is a practical and informative guide that provides a realistic roadmap for building wealth over time. Do you want to be the next millionaire next door? If so, grab it here.

4. “The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

Funny name, right? Well, this book is based on the principles of investing legend Jack Bogle, “The Bogleheads’ Guide to Investing” is a practical and straightforward guide to building a solid investment portfolio. Written by a group of avid investors known as the Bogleheads, the book covers a wide range of topics, including asset allocation, diversification, and index fund investing.

One of the key themes of the book is the importance of keeping investing costs low, which the authors argue can significantly impact your long-term returns.

They also emphasize the importance of staying the course and avoiding chasing after the latest investment trends.

Overall, “The Bogleheads’ Guide to Investing” is an excellent resource for beginners looking to build a strong

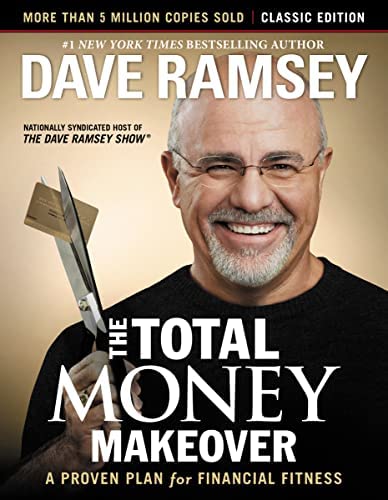

5. “The Total Money Makeover” by Dave Ramsey

“The Total Money Makeover,” presents a comprehensive plan for getting out of debt, building wealth, and achieving financial freedom. Based on Ramsey’s own experience with bankruptcy and recovery, the book provides a step-by-step guide to taking control of your finances, including budgeting, saving, and investing.

One of the key takeaways from the book is the importance of building an emergency fund and avoiding consumer debt, especially high-interest credit card debt.

Ramsey also encourages readers to create a debt repayment plan and to focus on paying off their debts in order of interest rate, starting with the highest rate first.

Overall, “The Total Money Makeover” is a practical and motivational guide that provides a clear path to financial stability and success.

Wrapping it up

Investing books can be an invaluable resource for beginners and experienced investors alike. Whether you are just starting out or looking to take your investing to the next level, these books offer valuable insights and strategies that can help you to succeed.

By choosing books that align with your investing goals and interests, taking notes and highlighting key points, reflecting on how the information applies to your own situation, and staying up to date with new developments, you can get the most out of these books and apply what you learn to your own investing approach.

As you continue on your investing journey, be sure to keep these books in mind as a source of inspiration, education, and guidance. With the right knowledge and approach, you can make informed financial decisions and achieve your long-term financial goals.