The envelope budgeting technique is a straightforward and practical way to handle your finances.

You can allocate a specific sum of money to each item and stay within your budget by using cash envelopes for each category of your spending plan. Making thoughtful purchasing selections and achieving your financial goals are made simpler by this practical method.

The first step to ensuring that this strategy works for you is to set up your envelope budget.

What is the cash envelope system for budgeting?

The cash envelope system for budgeting is a powerful tool for managing your finances and sticking to a budget. You can readily see where your money is going and modify as necessary by dividing your spending money into actual envelopes labeled for different expenses.

Setting Up Your Envelope Budget

Step 1: Determine Your Expense Categories

Choosing the spending categories you’ll utilize is the first step in putting the cash envelope technique into practice. Groceries, gas, entertainment, and other expenses are a few typical categories.

You can also make envelopes for saving up for big-ticket items like auto maintenance or vacations. You can make envelopes or folders labeled with the appropriate category once you’ve decided on your categories. If you want to lower your monthly expenses, I have articles on that, as well as ditching your subscriptions to lower your monthly expenses.

Step 2: Allocate Your Monthly Income

You must divide your monthly revenue among the envelopes after deciding on your spending categories. This requires figuring out how much cash you can reasonably set away each month for each category.

It is crucial to keep in mind that unforeseen costs will surely occur; therefore, it is sage to set aside some cash in a “miscellaneous” envelope for these costs.

Step 3: Use Your Cash Envelopes

You can begin using your cash envelopes after allocating your revenue to your cost categories. Simply take cash from the corresponding envelope and pay for your purchases.

You can move money from one envelope to another or from your savings account if you realize that one envelope is getting low on cash.

Step 4: Review and Adjust

The cash envelope strategy does not employ the “set it and forget it” mentality. Review your spending frequently, and adjust as necessary.

You might need to change your allocation for a category if you discover that you routinely run over or under budget in that category. During this period of reflection, you can also assess your general spending patterns and make any necessary adjustments.

Step 5: Use a tracking App

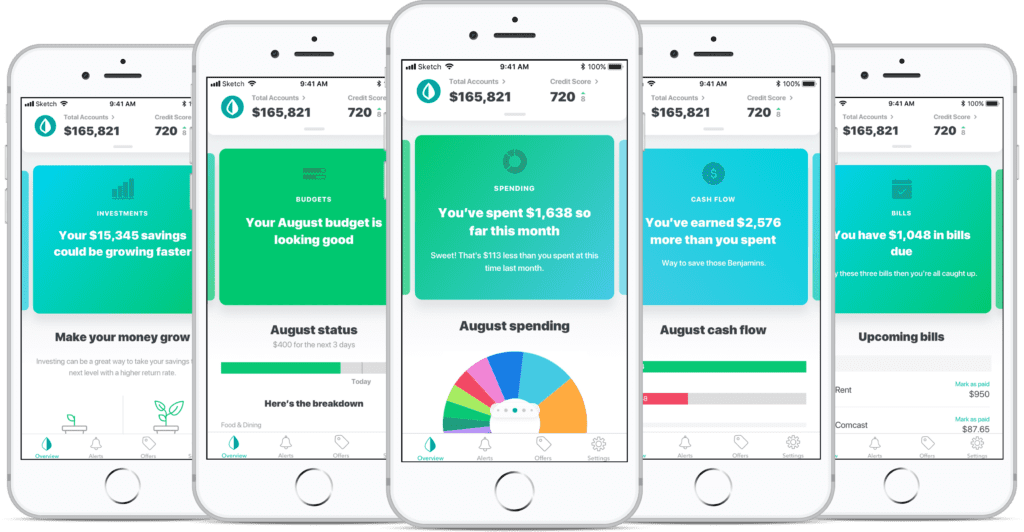

You can use a tracking app to help you stay on track with your spending if you don’t want to carry cash around.

You can establish a budget for each area and keep track of your spending. Knowing how much money is still in each area will be helpful. I have gone over my favorite budgeting apps here, or you can just jump to my favorite which is Mint by Intuit.

Tips for Success With a Budget Envelope System

- Start small. If you’re new to budgeting and the cash envelope system, it can be overwhelming to try to tackle all of your expenses at once. Start with just a few categories and gradually add more as you become more comfortable with the system.

- Be flexible. Life happens, and unexpected expenses will inevitably arise. Be willing to adjust your budget as needed and don’t beat yourself up if you overspend in a particular category.

- Use cash as much as possible. The cash envelope system is most effective when you’re using cash for your expenses. When you use a debit or credit card, it’s easy to lose track of how much you’re spending.

- Communicate with your partner. If you’re implementing the cash envelope system with a partner, it’s important to communicate and make sure you’re both on the same page.

How the cash envelope system can change the way you handle your money

The cash envelope approach can completely transform your financial situation since it makes you deliberate about every purchase. You have to physically hand over cash to make a purchase, which makes you more aware of how much you are spending as opposed to simply swiping a card and forgetting about it.

You’ll be able to track your spending as you use up the cash in each envelope. You can gain more control over your finances by using this transparency to help you make wiser financial decisions and break harmful spending patterns.

Additionally, you’ll be able to stick to your spending plan and prevent overspending by allocating a certain sum of money for each category. The cash envelope technique is unquestionably something to think about if you’re seeking for a budgeting method that may help you get control over your money.

Who is the cash envelope system best for?

The envelope budgeting method is best for people who are struggling to stick to a budget, people with irregular income streams and people who prefer a tangible and simple way to manage their money.

If you are looking for more advanced techniques, you can use technology such as budgeting apps or digital envelopes to supplement the cash envelope method. This can be helpful for tracking expenses and income on the go.

Try Out Cash Envelopes for Budgeting

Using the cash envelope approach to manage your finances and adhere to a budget can be quite effective. You may manage your money and reach your financial objectives by deciding on your cost categories, allocating your income, and frequently evaluating and changing your budget. Additionally, you may boost the likelihood that this budgeting strategy will be successful by starting small, being adaptable, using cash as often as possible, and speaking with your spouse.

Setting up a savings account for unforeseen expenses and long-term savings objectives is a crucial factor to take into mind when utilizing the cash envelope approach. This will guarantee that you have a safety net for unforeseen costs and that you are diligently pursuing your financial objectives.

Frequently Asked Questions

How do I decide how much money to put in each envelope?

To decide how much money to put in each envelope, start by identifying your expenses and setting a budget for each category. This can be at your bank statements or using a budgeting app. Once you have your categories and budgets, you can allocate a certain amount of money to each envelope. It’s important to remember that this is a flexible process and you may need to adjust your budgets as you go.

What do I do if I run out of money in an envelope before the end of the month?

If you run out of money in an envelope before the end of the month, you can either transfer money from another envelope or adjust your budget for that category. This is where the flexibility of the envelope budgeting method comes in, as you can adjust your spending habits and budget accordingly.

Can I use this method with credit cards or just cash?

The envelope budgeting method can be used with cash, debit cards, or even credit cards. The key is to assign a set amount of money to each budget category and stick to that amount. For example, you can put a certain amount of cash in an envelope for groceries and use a debit card linked to that envelope for your grocery purchases.

How do I handle larger or irregular expenses?

For larger or irregular expenses, you can set aside money in a separate envelope or create a sinking fund. A sinking fund is a savings account where you set aside money each month for a specific future expense, such as a vacation or a new appliance.

Can I use this method with online banking?

Yes, you can use the envelope budgeting method with online banking. You can set up virtual envelopes or categories in your online banking account and transfer money into them each month.

Can I use this method with joint accounts?

Yes, the envelope budgeting method can be used with joint accounts as well. It’s important to have open communication with your partner and set clear budget and spending guidelines for the joint account.