A wonderful strategy to create a steady income stream is to invest in dividend-paying equities. Investors can generate a consistent income by funding dividend-paying businesses without having to liquidate their equity holdings. For retirees or people trying to supplement their income, this is very helpful.

In this post, we’ll examine the advantages of living off dividends in more detail, as well as how to create a reliable source of income.

What is Dividend Income?

Dividend income is a regular payment made by a company to its shareholders, usually on a quarterly basis. It is a way for companies to share their profits with their investors, and it can provide a steady stream of income for retirees who own dividend-paying stocks. Dividend income is what I consider the only true form of passive income.

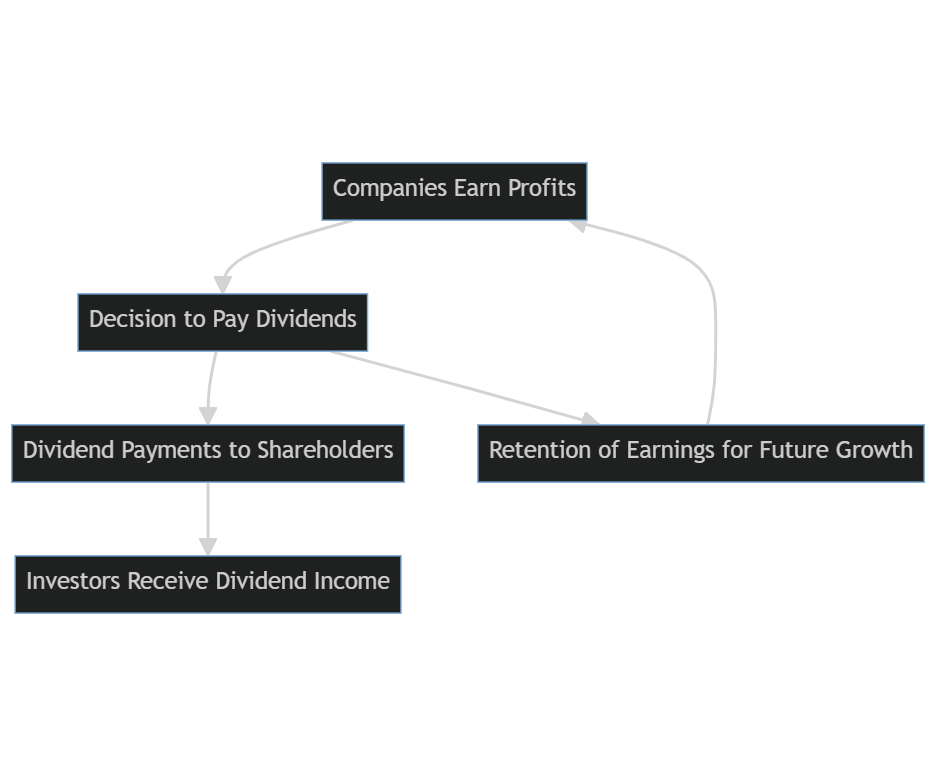

- The process starts with companies earning profits.

- The company then makes a decision on whether to pay dividends to shareholders or retain earnings for future growth.

- If the company decides to pay dividends, the payments are made to shareholders.

- If the company decides to retain earnings, the money is kept for future growth and reinvestment in the company.

- Investors receive dividend income from the payments made by the companies they have invested in.

The Benefits of Living Off Dividends

- Regular Income: Without needing to sell stock, dividends offer a consistent income stream. This enables investors to keep holding shares in solid companies and continue to gain from capital growth. A consistent dividend stream can also provide one a feeling of stability and financial security.

- Lower Risk: Equities that pay dividends typically have lower volatility than non-dividend paying stocks. This is because businesses that pay dividends frequently have longer histories and a more reliable track record of performance. They typically exhibit greater stability and are less susceptible to sudden reductions in value.

- Potential for Capital Appreciation: Dividend-paying equities have the chance to increase in value in addition to generating monthly income. The stock price will probably rise as the business develops and gains value. As a result, investors are able to gain from both consistent income and long-term investment growth.

How to Build a Sustainable Dividend Income Stream

Combining risk management with investing in dividend-paying equities is necessary to create a reliable income stream. Here are some pointers to get you going.

- Diversify Your Portfolio: To effectively manage risk, you must diversify your portfolio. You can lessen your exposure to any one firm or industry by investing in a range of dividend-paying companies. In the event of a slump in any certain industry, this can aid in protecting your capital.

- Invest in Businesses with a Proven Track Record of Paying Dividends: It’s crucial to put money into businesses with a proven track record of generating dividends. This makes it more likely that the income stream will be long-term sustainable. Companies with a track record of dividend payments are more likely to do so in the future.

- Dividend reinvestment: Over time, reinvesting dividends can help your income stream expand. You can take advantage of compounding gains by using the dividends to buy more stock. This implies that since the dividends gained on your initial investment likewise earn dividends, your income stream may increase exponentially over time.

- Regularly check your dividend-paying stocks: It is crucial to monitor the operating results and dividend practices of the businesses you have invested in. During difficult circumstances, some businesses may reduce or suspend their dividend payments. You can make necessary adjustments to your portfolio to make sure it continues to suit your income demands by constantly checking your investments.

How Much Money Do You Need to Live Off of Dividends?

Your desired standard of living and the size of your portfolio are two important considerations when determining how much money you will need to survive off dividend income in retirement. To create enough revenue to pay your needs, you need a portfolio of about $1 million, according to the conventional rule of thumb.

You may anticipate receiving $30,000 in dividends a year if you had a $1 million portfolio and invest in equities with a 3% average yield. Although it might not be enough to pay all of your needs, this might be a sizable addition to other income streams like Social Security or a pension.

As another illustration, if you have a $500,000 portfolio and invest in equities with a 4% average yield, you can anticipate receiving $20,000 in dividends year. This might be enough to pay for the necessities of life, but it might not be enough to maintain a luxurious lifestyle.

It’s important to remember that the aforementioned examples are simply broad estimations, and the actual numbers may differ. You should be aware that the size of your portfolio, its yield, and the amount of your dividend income are all influenced by changes in the stock market. To build a thorough retirement income plan and to ascertain the precise amount of money you require to live off of dividends, it is crucial to speak with a financial counselor.

Best Dividend-Paying Stocks and ETFs

When it comes to investing in dividend-paying stocks and ETFs, there are a number of options to choose from. Here are a few of the best:

- Blue Chip Stocks: Blue chip stocks, such as those in the Dow Jones Industrial Average or the S&P 500, are known for their stability and steady dividend payments. Some examples include Procter & Gamble (PG), Coca-Cola (KO), and Johnson & Johnson (JNJ).

- Dividend Aristocrats: Dividend Aristocrats are stocks that have increased their dividend payments for 25 consecutive years or more. These stocks are considered to be some of the most reliable dividend payers and include companies such as 3M (MMM) and Walgreens Boots Alliance (WBA).

- High-Yield Stocks: High-yield stocks, also known as “income stocks,” are stocks that pay dividends that are higher than the average dividend yield of the stock market. Some examples include AT&T (T) and Verizon (VZ).

- Dividend ETFs: For those looking for a more diversified approach to dividend investing, there are a number of dividend ETFs available. These ETFs track a basket of dividend-paying stocks and can provide a more stable and reliable income stream. Some popular dividend ETFs include the SPDR S&P Dividend ETF (SDY) and the Vanguard Dividend Appreciation ETF (VIG).

- High Yield Dividend ETFs: Similar to High-Yield Stocks, these ETFs track a basket of high-yield dividend-paying stocks which provide higher than average dividends yield. Some examples include iShares Select Dividend ETF (DVY) and SPDR S&P Dividend ETF (SDY)

The Benefits of Dividends and Capital Gains for Tax Purposes

Your income when employed full-time is subject to federal income taxes at a rate based on your yearly income threshold.

The tax rate on dividend and capital gain income is, however, much lower after retirement. For instance, the 15% capital gains tax rate would be used instead of the higher ordinary income tax rate if you had a $1 million portfolio and earned $31,000 in dividends.

The lifespan of your retirement portfolio may be significantly impacted by this advantageous tax treatment for dividends and capital gains. Your portfolio’s lifespan may eventually be extended by the tax savings, enabling you to maintain your lifestyle in retirement.

Key Takeaways

Living off of dividends can be a fantastic method to create a steady income. Investors can generate consistent income without having to sell stock by choosing dividend-paying stocks and controlling risk.

You can potentially create a sustainable income stream that will continue for many years by diversifying your portfolio, investing in businesses with a proven track record of paying dividends, reinvesting dividends, and keeping a close eye on your investments.

Frequently Asked Questions

Q. What distinguishes dividend income from other forms of investment income?

Company’s distribution to its shareholders in the form of dividend income normally occurs once every three months. Other forms of investment income, such as interest from bonds or capital gains from the sale of securities, are different from this.

Q. Which stocks have the highest dividend yields?

Companies in the utility, consumer products, and healthcare industries, as well as blue-chip firms, are some examples of the finest dividend-paying stocks. Also, a solid choice is Exchange Traded Funds (ETFs) that follow dividend-paying stocks.

Q: Where can I find stocks that pay dividends?

Companies with a high dividend yield—defined as the annual dividend payment divided by the stock price—are likely to have stocks that pay dividends. Additionally, lists of dividend-paying equities are available on several financial websites and databases.

Q. How does my retirement portfolio benefit from the advantageous tax treatment for dividends and capital gains?

Dividends and capital gains income are normally taxed at a lower rate in retirement than ordinary income. By lowering the amount of taxes paid on investment income, this can aid in extending the lifespan of your retirement portfolio.

Q. How often are dividend payments made?

Although some businesses may pay dividends on a semi-annual or annual basis, dividends are normally paid on a quarterly basis.

Q. How may dividends be reinvested?

A dividend reinvestment plan (DRIP), which uses your dividend payments to automatically buy more shares of the stock, allows you to reinvest dividends.