Moving out of your parents’ home and into your own place is a big step, and it can be an exciting but also stressful experience. One of the biggest concerns is often how much money you need to move out and how to budget for it.

Today we will cover some key considerations you must be aware of before taking the leap into your own place.

How much money do you need before you can move out of your parents’ house?

It’s difficult to determine a specific amount of money you need to move out of your parents’ house as it will depend on your location and personal financial situation. However, you should save between $4,000 and $16,000 before moving out. This should cover costs such as moving expenses, rent, furniture, and pay monthly bills.

It’s also important to have an emergency fund in place to cover unexpected expenses. By creating a budget and planning ahead, you can determine how much money you need and work towards saving up the necessary funds.

Tips on how to plan for this major life event:

Determine your budget:

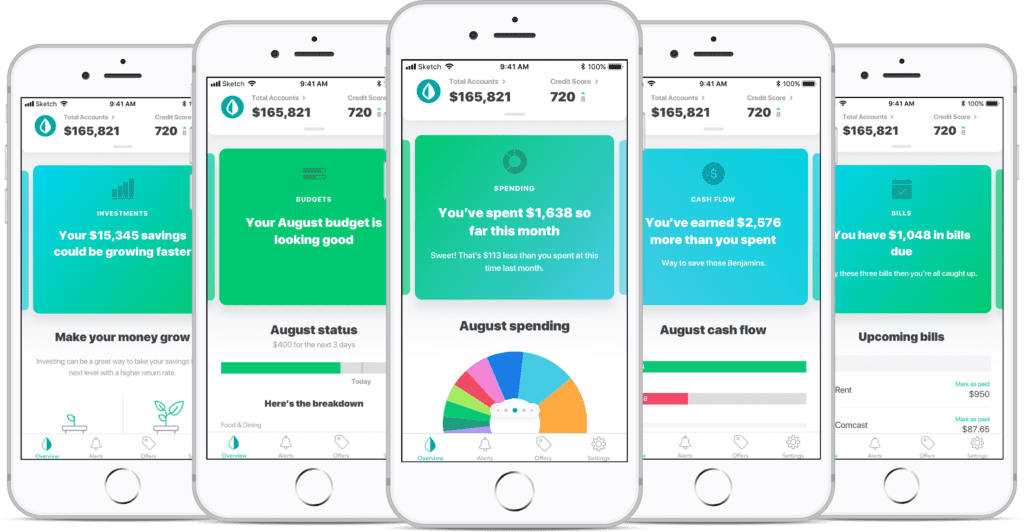

The first step in preparing to move out is to determine your budget. This includes not only the cost of rent, but also utilities, groceries, insurance, and other expenses. Use a budgeting app like Mint or spreadsheet to track your income and expenses and determine how much you can afford to spend on rent each month.

This is a crucial step and if you need more information on what budgeting apps or sites to use, I have written a whole article on the subject.

Save up for a security deposit:

In addition to your monthly rent, you will also need to pay a security deposit when you move into a new place. This is typically the equivalent of one to two month’s rent and is used to cover any damages to the property when you move out. It’s important to start saving up for this as soon as possible, so you have the funds available when you need them.

Consider roommate options:

If you are struggling to afford rent on your own, you may want to consider getting a roommate. Sharing the cost of rent and other expenses with someone else can significantly reduce the burden on your budget.

Just be sure to communicate clearly with your roommate about expectations and boundaries and have a written agreement in place to avoid misunderstandings.

Get your finances in order:

Before you move out, it’s a good idea to get your finances in order. This includes making sure you have a steady income, paying off any debts, and establishing an emergency fund to cover unexpected expenses.

Having a solid financial foundation will help you feel more secure and prepared for the challenges of living on your own.

Shop around for the best deal:

Definitely do not be afraid to shop around for the best deal on rent and other expenses. Look for deals and discounts, negotiate with landlords, and consider living in a less expensive area if necessary.

By being proactive and looking for ways to save money, you can stretch your budget further and make the transition to living on your own more manageable.

When I moved into my first apartment, I was able to get two months free, and use that credit to make my whole first years rent significantly cheaper.

Plan for moving expenses:

Don’t forget to budget for moving expenses, such as the cost of hiring movers, renting a truck, or paying for storage. These costs can add up quickly, so it’s important to plan ahead and set aside enough money to cover them.

Set up utilities:

Make sure you set up utilities, such as electricity, gas, water, and internet, in your new place before you move in. You may need to pay a deposit or sign up for a service contract, so be prepared for these additional expenses.

Get renters insurance:

Renters insurance is a good idea to protect your belongings in case of damage or theft. It’s typically affordable and can give you peace of mind knowing that your possessions are covered.

Consider your long-term goals:

Finally, think about your long-term goals when moving out. Are you planning on staying in your new place for a while, or do you see yourself moving again in the near future? This will help you make decisions about how much money to spend on rent and other expenses and whether it makes more sense to rent or buy a home.

Moving out and setting up your own place is a big step, but with careful planning and budgeting, it can be a rewarding and exciting experience. By following these tips, you can ensure that you have the financial resources and support you need to make a smooth transition to your new home.

Moving on a Tight Budget

Moving out of your parents’ home or moving in general can be an exciting but also stressful experience, especially if you are on a tight budget.

While rent and other expenses can add up quickly, there are ways to make the transition to living on your own more manageable. Here are some tips for moving out on a tight budget:

Look for ways to save on rent:

One of the biggest expenses when moving out is rent, so finding ways to save on this cost can make a big difference. Consider living in a less expensive area or opting for a smaller apartment or room.

You could also look for a place with utilities included or negotiate with the landlord for lower rent.

Get a roommate:

If you are struggling to afford rent on your own, you want to consider getting a roommate. Imagine having your rent cut in half, it’s a huge way to save money.

Cut unnecessary expenses:

Another way to stretch your budget further is to cut unnecessary expenses. Look for ways to save on groceries, transportation, and entertainment costs. For example, you could cook at home instead of eating out, take public transportation instead of driving, or find free or low-cost entertainment options.

Create a budget and stick to it:

One of the keys to moving out on a tight budget is to create a budget and stick to it. Use a budgeting app or spreadsheet to track your income and expenses and identify areas where you can cut costs. Be disciplined about sticking to your budget and avoiding unnecessary expenses.

Build an emergency fund:

Finally, it’s important to have an emergency fund in place to cover unexpected expenses. This can help you avoid going into debt or having to borrow money when something unexpected happens. Aim to save at least three months’ worth of living expenses in your emergency fund, so you have a cushion to fall back on in case of an emergency.

Moving out on a tight budget can be challenging, but with careful planning and budgeting, it is possible to make the transition to living on your own more manageable. By following these tips, you can ensure that you have the financial resources and support you need to make a smooth transition to your new home.

Hit the Road

Moving out of your parents’ home and into your own place can be a thrilling but also intimidating experience, especially if you are on a tight budget. However, with careful planning and budgeting, it is possible to make the transition to living on your own more manageable.

By looking for ways to save on rent, getting a roommate, cutting unnecessary expenses, and building an emergency fund, you can stretch your budget further and feel more financially secure in your new home. It’s also important to seek out financial assistance if you need it and to be proactive about managing your finances after moving out.

With the right approach, you can set yourself up for success as a first-time renter and enjoy the freedom and independence of living on your own.