Although it might be a thrilling first step toward independence, moving out also carries a lot of financial responsibilities. How much money do I need to save up before moving away is a common question.

The answer relies on a number of variables, including the location, the type of housing, and the lifestyle preferences.

This article will cover the many moving-related costs you should take into account and give you a rough idea of how much cash you will need to set aside for the big move.

Calculate Your Monthly Expenses

Let’s get into the first step in preparing to move out. I would say in almost all cases that this step should be to calculate what your monthly expenses are likely to be.

It makes sense because you are going to need an idea of how much money it will take to cover your monthly expenses. A few items to take into account include housing costs, utilities, groceries, transportation, and any other bills you may have.

Housing Costs

When moving out, housing costs are often the biggest expense. You can be looking at a high cost of living depending on where you are, especially if you intend to live in a big city. Depending on elements like the size of the property and the amenities offered, the cost of renting or purchasing a home or apartment might differ significantly.

It’s crucial to investigate the local housing market to find out how much you should budget.

Security Deposits and Moving Costs

A security deposit must be paid before relocating into a new house or apartment that you are renting. This deposit, which is normally one or two months’ worth of rent, is used to cover any damages or unpaid rent that may arise at the end of your lease. Expenses associated with moving can also mount, particularly if you hire professional movers or lease a moving vehicle.

Utilities

When you move out, you’ll need to set up utilities such as electricity, gas, water, and internet. These bills can add up quickly, especially if you’re living in a large home or apartment.

It’s essential to budget for these expenses to ensure that you can afford to keep the lights on and the water running.

A great way to prepare for this is to estimate what your utilities will be with a utility estimate calculator.

Food and Groceries

Budgeting for food and groceries is necessary because these costs can quickly accumulate, especially if you dine out frequently. By preparing meals at home and organizing your food shopping in advance, you can save money.

Transportation

Transportation costs can also add up quickly, especially if you’re commuting to work or school. If you plan to drive, you’ll need to budget for expenses such as gas, maintenance, and insurance. If you’re taking public transportation, you’ll need to factor in the cost of tickets or passes.

Miscellaneous Expenses

Miscellaneous expenses such as clothing, entertainment, and personal care products should also be considered when moving out. While these expenses may seem small, they can add up quickly and impact your overall budget.

Related: Save money canceling unused subscriptions

Set a Realistic Moving Budget

Once you have an idea of your monthly expenses, you can set a moving budget. A moving budget includes all the expenses associated with moving, such as moving truck rentals, packing supplies, and hiring movers. You’ll need to factor in these costs and add them to your monthly expenses to determine your total moving budget.

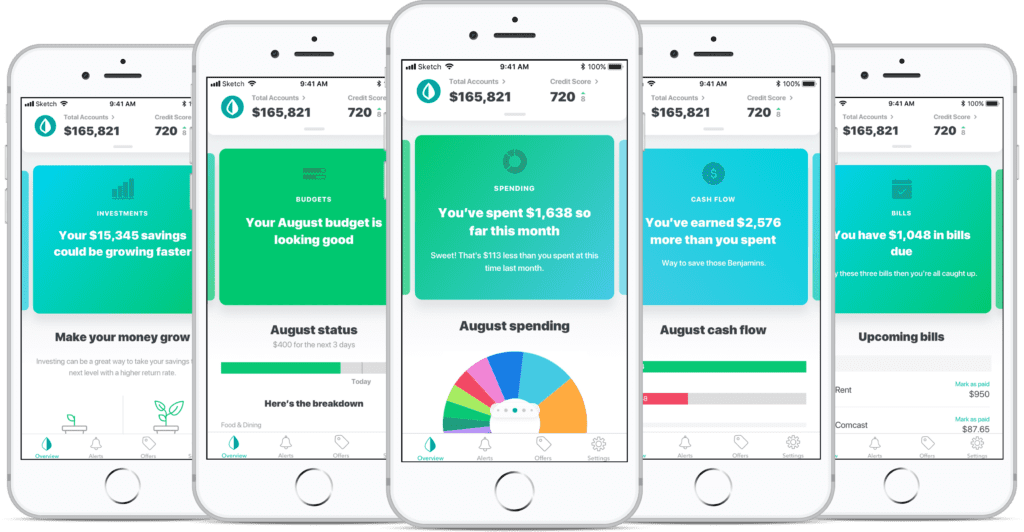

Related: Best Budgeting Apps

Determine Your Moving Date

Knowing when you plan to move can help you determine how much time you have to save. If you’re not in a rush to move, you’ll have more time to save up for your moving expenses. On the other hand, if you need to move quickly, you may need to save more aggressively.

Start Saving Early

The earlier you start saving, the better. It’s recommended that you start saving at least six months before your moving date. This will give you enough time to build up your savings and ensure that you have enough money to cover your moving expenses.

Cut Back on Unnecessary Expenses

To save more effectively, you may need to cut back on some of your unnecessary expenses. This can include eating out less, canceling subscription services you don’t use, and finding cheaper alternatives for entertainment.

Find Ways to Increase Your Income

If you’re having trouble saving enough, you may need to find ways to increase your income. This can include taking on a part-time job, selling items you no longer need, or freelancing in your spare time.

Consider Your Security Deposit

Don’t forget to factor in your security deposit when saving for your move. Most landlords require a security deposit that’s equal to one or two months’ rent. This can be a significant expense that you’ll need to prepare for.

So, How Much Money Do You Need to Move Out?

Based on the expenses discussed above, the amount of money you need to move out will vary depending on your lifestyle and location. As a general rule of thumb, it’s recommended that you have at least three to six months’ worth of living expenses saved up before moving out. This amount should cover your rent or mortgage payments, utilities, groceries, transportation, and other necessary expenses.

If you’re moving to a high-cost area, you may need to save more. It’s also essential to keep in mind that unexpected expenses can arise, such as medical bills or car repairs. Having an emergency fund set aside can help you weather any unexpected financial storms.

Time to Move out

Moving out requires careful planning and preparation, especially when it comes to your finances. By calculating your monthly expenses, setting a realistic budget, and starting to save early, you can ensure a smoother and less stressful transition. Remember to cut back on unnecessary expenses, find ways to increase your income, and factor in your security deposit to help you save more effectively.

Frequently Asked Questions

How much money should I save before moving out?

It’s recommended that you save at least three to six months’ worth of living expenses before moving out. This includes rent, utilities, groceries, transportation, and other necessary expenses. You should also have some money set aside for unexpected expenses.

What expenses should I consider when moving out?

Aside from rent and utilities, there are other expenses to consider when moving out. These may include groceries, transportation, furniture, security deposit, renters insurance, and moving expenses. It’s important to create a budget and plan ahead for these expenses.

Should I rent or buy a place to live?

This decision depends on your financial situation and personal goals. Renting allows for more flexibility and less financial commitment, while buying a home can build equity and provide long-term stability. Consider your financial situation and long-term goals before making a decision.

How much should I spend on rent?

A general rule of thumb is to spend no more than 30% of your income on rent. However, this may vary depending on your location and income. It’s important to consider your budget and financial goals before deciding on a rental price range.

What if I can’t afford to move out?

If you’re unable to afford to move out at the moment, there are still steps you can take to prepare for the future. Start by creating a budget and saving as much as possible. Look for ways to increase your income, such as taking on a side job or negotiating a raise at your current job. You may also consider finding a roommate or living with family temporarily to save on living expenses.