Investing in the stock market can be a great way to grow your wealth over time, but it can also be a volatile and unpredictable process.

Market fluctuations are a normal part of the investing process, and it can be challenging to know when to buy and sell in order to maximize your returns.

One strategy that can help investors navigate this volatility is dollar-cost averaging. As discussed in my previous post about the importance of investing for a long-term horizon, strategies such as this will help you be a more sound investor.

What is dollar-cost averaging?

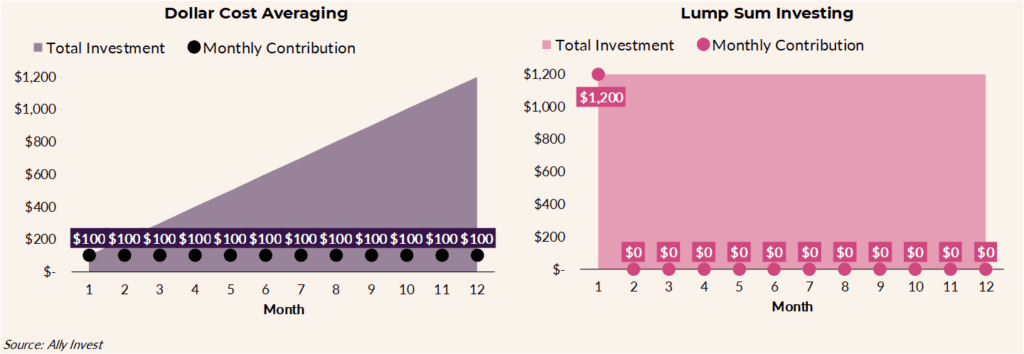

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This can be a good way to smooth out the ups and downs of the market and potentially increase your chances of success over the long term.

For example, let’s say you have $1,000 that you want to invest in the stock market. Instead of investing the entire amount at once, you could implement a dollar-cost averaging strategy by investing $100 per month for 10 months.

This way, you are not trying to time the market and instead are consistently investing a fixed amount over time.

Why is dollar-cost averaging effective?

There are several reasons why dollar-cost averaging is an effective strategy for can be investing in a volatile market:

1. It helps to smooth out market fluctuations:

By investing a fixed amount at regular intervals, dollar-cost averaging helps to smooth out the ups and downs of the market.

This can be especially beneficial during times of market volatility, as it allows you to consistently invest without trying to time the market.

2. It can reduce risk:

Dollar-cost averaging can also help to reduce the risk of investing in the stock market.

By investing a fixed amount over time, you are less likely to be affected by short-term market movements and more likely to benefit from the long-term potential for higher returns.

3. It can be less emotionally challenging:

Investing can be an emotional process, and it can be tempting to make impulsive decisions based on short-term market movements.

Dollar-cost averaging can help to reduce the emotional element of investing by allowing you to consistently invest a fixed amount over time, rather than trying to time the market.

As a new investor, it can be demoralizing to lose a big chunk of your investment, but if you are implementing this strategy, you will reduce the ups and downs of the market.

If you are unsure where to start as a new investor, I recommend checking out my article on my favorite investment apps for beginners.

How to implement dollar-cost averaging

Here are a few tips on how to implement a dollar-cost averaging strategy in your investment portfolio:

1. Choose an investment:

Dollar-cost averaging can be applied to a variety of investment vehicles, such as stocks, mutual funds, or exchange-traded funds (ETFs). Choose an investment that aligns with your financial goals and risk tolerance.

2. Determine your investment amount and interval:

Decide how much you want to invest and how often you want to make investments. For example, you might choose to invest $100 per month or $500 every quarter.

3. Set up automatic investments:

One of the easiest ways to implement dollar-cost averaging is to set up automatic investments through a brokerage account. This way, you can automatically invest a fixed amount at regular intervals without having to manually make investments each time.

One of the simplest ways to implement this strategy is to start with an app like Acorns, that will atomically invest spare change from your transactions, as well as the option to set a recurring monthly investment.

4. Review and adjust as needed:

It’s important to periodically review your dollar-cost averaging strategy to ensure that it is still aligned with your financial goals and risk tolerance.

You may need to adjust the amount or interval of your investments as your financial situation or investment goals change.

Importance of Sound Investment Strategies

Dollar-cost averaging is a strategy that can be an effective way to invest in a volatile market. By consistently investing a fixed amount over time, you can smooth out the ups and downs of the market and potentially increase your chances of success.

It’s important to choose an investment that aligns with your financial goals and risk tolerance, and to periodically review and adjust your strategy as needed.

By being disciplined and proactive in your investing approach, you can increase your chances of reaching your financial goals over the long term.