You finally made it to the “real world”, congratulations! Up to this point you have spent what feels like your whole life as a student. Now that you are out of college you may be lucky enough to have landed that dream job, or like most of us, a job that hopefully pays the bills and will pass for now.

While many of us had to spend our money strategically in college, now that we are out it has become more important than ever. You have your housing expenses, everyday expenses, and possibly student loan debt.

Today I will give some of my tips and strategies that helped me navigate the “real world” financially after graduating from college.

Let’s get into it!

Track your spending

A budget can help you understand where your money is going and identify areas where you may be overspending.

There are plenty of ways to track your spending, but I have found that using a budgeting website or app typically works best for me.

I wrote a whole article on the best budgeting apps, but for today’s purposes I will recommend the one I used the most, and that is Mint.

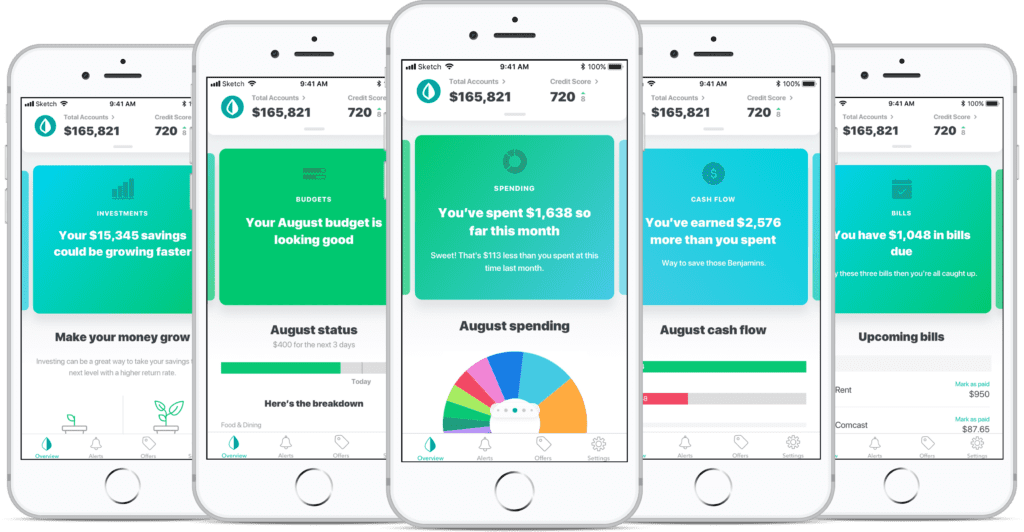

Mint is a budgeting and personal finance app that allows you to track their spending, create a budget, and manage their finances.

The most important aspect for me was the fact that you can connect your bank and credit card accounts, and the app will automatically categorize your transactions and track your spending in real time.

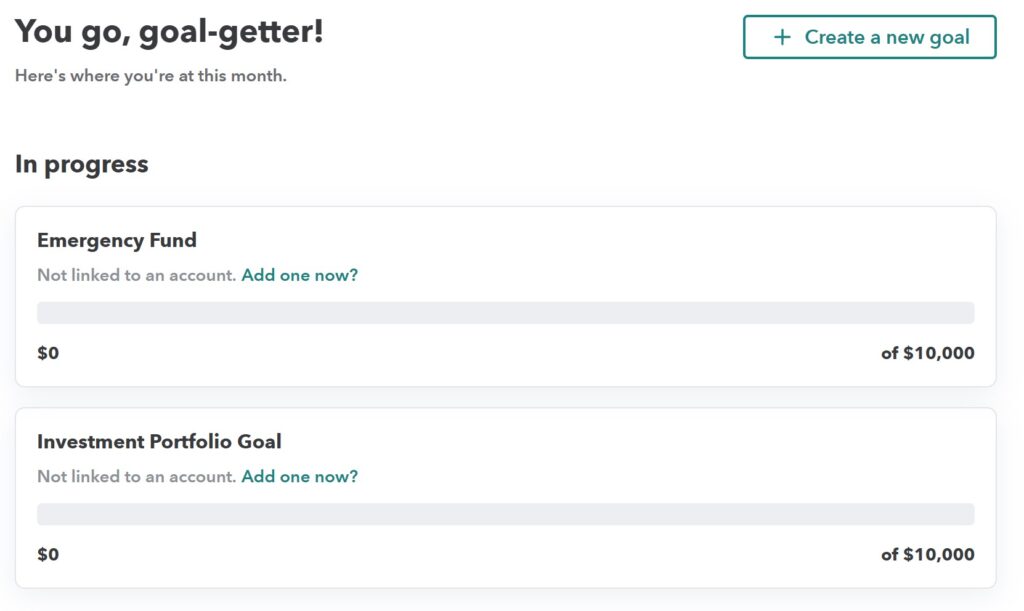

You can also set financial goals, today we want to focus on paying off debt (if you do happen to have student loan debt, and the app will provide tools and resources to help you reach that goal.

Some of my favorite features of Mint include:

- Automatic categorization of transactions

- Budgeting tools

- Bill reminders

- Credit score tracking

- Investment tracking

The point is, there are many comprehensive budgeting and personal finance apps that can help you manage your money, so I strongly recommend you use one.

Set financial goals

As we discussed briefly above, a goal such as paying off your student loans is an excellent financial goal that a budget can help you set and prioritize.

In addition to paying off debt, this is the time of your life where it is crucial to start investing your money if you are able to, as well as saving up an emergency fund.

Paying off those pesky student loans

Here are some quick tips while paying down your student loan debt:

- Once you track your spending and see what kind of surplus you may have after all expenses, do your best to pay more than the minimum payments on your loan balances.

- Interest is the enemy- the faster you can pay down your debts, the less interest will accrue, saving you thousands of dollars in the long run.

Investing Your Money

My biggest tip in terms of investing post grad is to utilize start investing your money for retirement. Many employers have retirement plan contribution matching, this is free money!

Starting early to build your retirement account will equate to hundreds of thousands, to millions more come retirement time. This may seem like a far way out, but it is never too early to start and compound interest is the 8th wonder of the world!

I would also recommend investing outside of your retirement fund. If you want to know how and where to get started, check out my article on the best investment apps for beginners.

Saving Your Money

Just as important as investing, and paying down debt, having a good nest egg is crucial to whether and financial storm that may come up.

I have a whole article on why it is important to start an emergency fund, as well as tips and tricks to starting one. I recommend you read that after this article.

Make informed financial decisions:

Just by reading this article, you are clearly taking the proper steps to make informed financial decisions, so kudos for that!

By understanding your income and expenses, you can make more informed decisions about how to allocate your money and make the most of your financial resources.

This may mean shopping extra carefully for that apartment, gym membership, and really running the numbers before making a large purchase.

Stay on track

A budget is extremely helpful at helping you stay on track with your financial goals and avoid overspending or falling into debt.

Be persistent! A budget is only helpful if you actually use is and learn from it.

Just like anything you want to succeed at you need to be persistent and continue to track your budget and continue to make sound decisions with your money.

Improve financial stability

By managing your money wisely and keeping track of your spending, you can improve your overall financial stability and reduce financial stress.

Another way to improve your financial stability is by making more money! While this may not be feasible at your job given you are fresh out of college, that does mean that all hope is lost.

Consider picking up a side hustle or second job part time to increase your income. All over this site I advocate for readers to consider trying out a side hustle if they have the ability and time to do so.

There are plenty of side hustles you can try, with more passive ones being online side hustles, and more active ones being something like flipping furniture. I urge you to try some out and do your own research to see if any of these separate income sources could be a good fit for you.

Conclusion

Budgeting is an important tool for managing your money and achieving your financial goals after college. By tracking your income and expenses and setting financial goals, you can make informed decisions about how to allocate your money and improve your overall financial stability.

While budgeting may take some time and effort, it can pay off in the long run by helping you stay on track with your finances and avoid overspending or falling into debt. So, it is crucial for post-grads to start budgeting as soon as possible to set themselves up for financial success in the future.

Good luck on your financial journey, hop around the rest of our articles for more helpful information!