The Power of the 50/30/20 Rule: How to Create a Balanced Budget and Save Money

Creating a budget can seem like a daunting task, but it doesn’t have to be. The 50/30/20 rule is a simple, yet effective, budgeting strategy that can help you create a balanced budget, pay off debt, and save money. In this article, I will explain the rule, how it works, and how to implement it […]

Maximizing Revenue: Make Money with Your Small Blog

Starting a blog can be a great way to share your thoughts, ideas, and experiences with the world. But did you know that it can also be a way to make money? There are a number of proven ways to make money with your small blog. With the right monetization strategies, even a small blog can […]

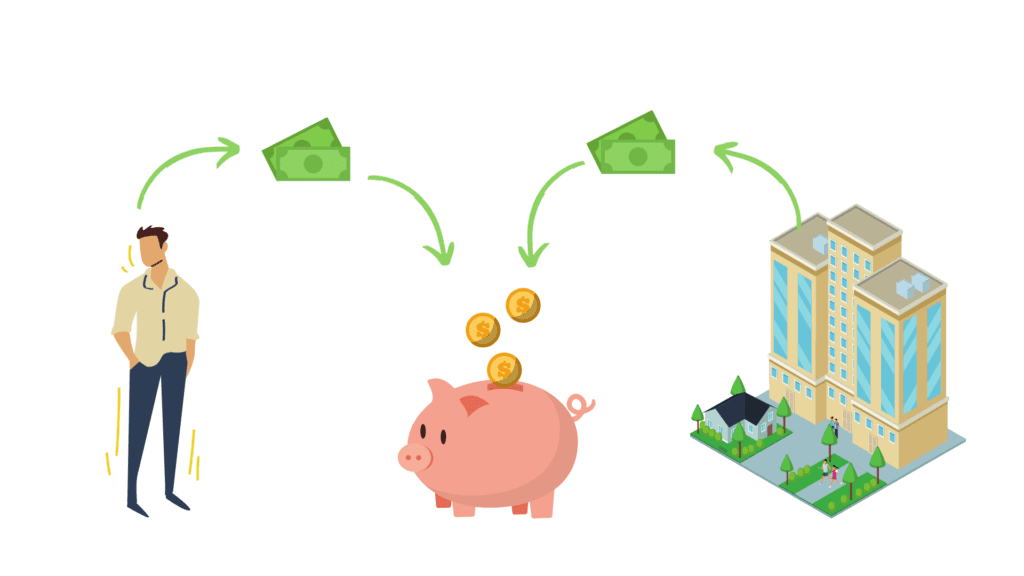

Passive vs Active Income: Understanding the Differences and How to Make Money

In the world of personal finance, there are two main types of income: passive and active. Understanding the differences between the two, as well as their pros and cons, can help you make informed decisions about how to make money and create a diversified income stream that meets your financial goals and lifestyle. Passive Income […]

Monetizing Your Drone: 6 Ways to Make Money with Your Drone

The use of drones has grown rapidly in recent years, and it has become an increasingly popular tool for businesses and individuals. Drones are no longer just a hobby, but rather, a powerful tool for making money. Making money with your drone is easier than ever, today I will explain a few ways to make […]

Redbubble Vs Etsy: What’s Best for Print On-Demand Profit?

Print-on-demand (POD) has become a popular way for artists and designers to sell their work without having to worry about maintaining inventory or dealing with shipping logistics. One of the biggest debates is where to sell your products, today I will get into Redbubble vs Etsy for selling Print On-Demand products. POD is one of […]

Retire Rich: Secrets of The Backdoor Roth IRA Explained

Investing for retirement is a young man (or woman’s) game, the earlier you start the better. I have dug into a few topics in regard to retirement saving including maximizing your employer’s contribution matches. A backdoor Roth IRA is a way for individuals who earn too much money to contribute directly to a Roth IRA […]

The $1,000 Challenge: Achieving Your Saving Goal and More

The ability of saving money is a crucial part of managing your finances and achieving your financial goals. Whether you’re looking to build an emergency fund, save for a down payment on a house, or just have some extra cash on hand, setting a goal to save a specific amount of money can be […]

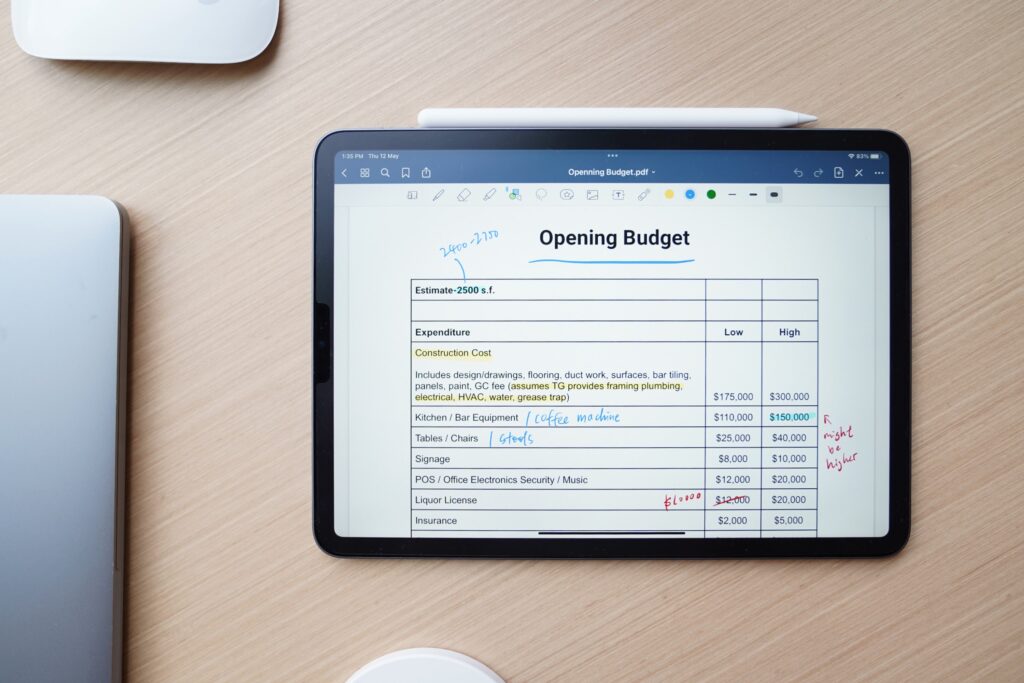

How to afford moving out of your parents’ home

Moving out of your parents’ home and into your own place is a big step, and it can be an exciting but also stressful experience. One of the biggest concerns is often how much money you need to move out and how to budget for it. Today we will cover some key considerations you must […]

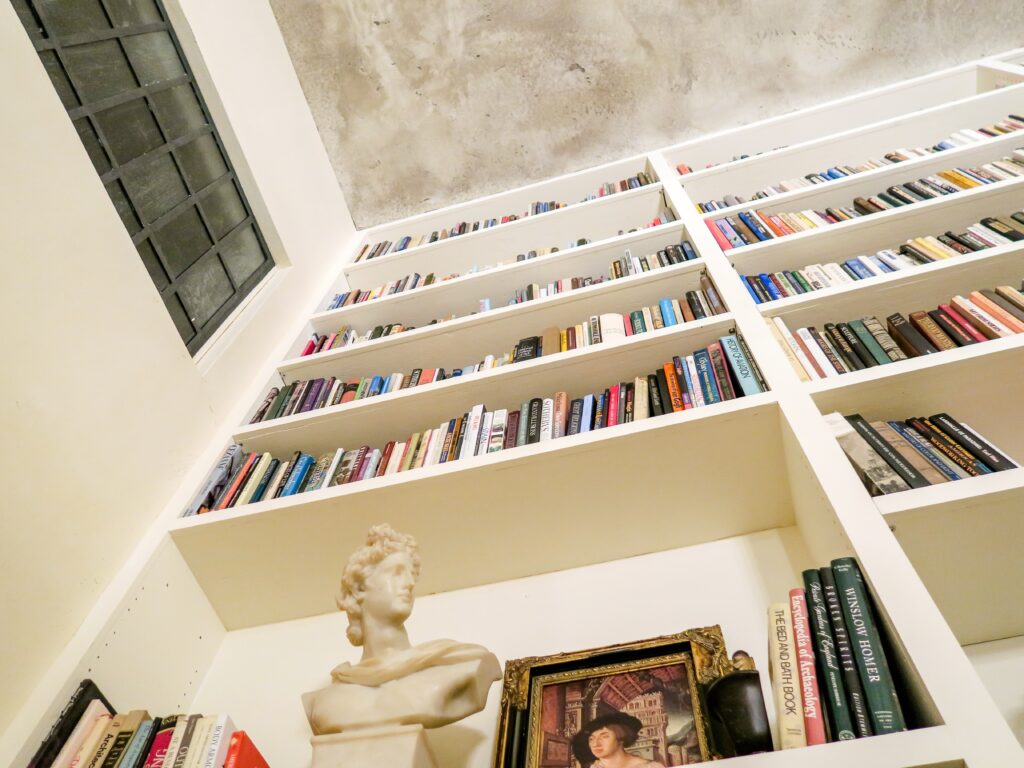

The 5 Crucially Important Investing Books for Beginners

If you have found your way to this article, it does not matter if you are a beginner or seasoned investor, if you have $100, or $1 million it can be overwhelming to navigate the world of investing and make informed financial decisions. Something that helped me aside from diving into research online, or through […]

Tips to Maximize Your Employer’s Retirement Match: Retire Rich

As a person who works in the financial sector (and runs a personal finance blog), one question I hear often from friends and family is “How can I maximize my employer’s retirement plan contribution match?” It’s a good question, a great one really, as the contribution match is essentially free money that can significantly boost […]