Budgeting is important for couples for a number of reasons. First and foremost, it can help couples to better understand their financial situation and make informed decisions about how to allocate their resources. This can be especially important if the couple has joint financial goals, such as saving for a down payment on a house or paying off debt.

Budgeting can also help couples to identify and address any financial issues or imbalances within the relationship. For example, if one partner is spending significantly more than the other, a budget can help to bring this issue to light and allow the couple to discuss and come up with a plan to address it.

In addition, budgeting can help couples to avoid financial stress and conflict. When both partners have a clear understanding of the household’s financial situation and are working towards shared financial goals, it can reduce the likelihood of misunderstandings or arguments about money.

Top 5 Budgeting Apps for Couples

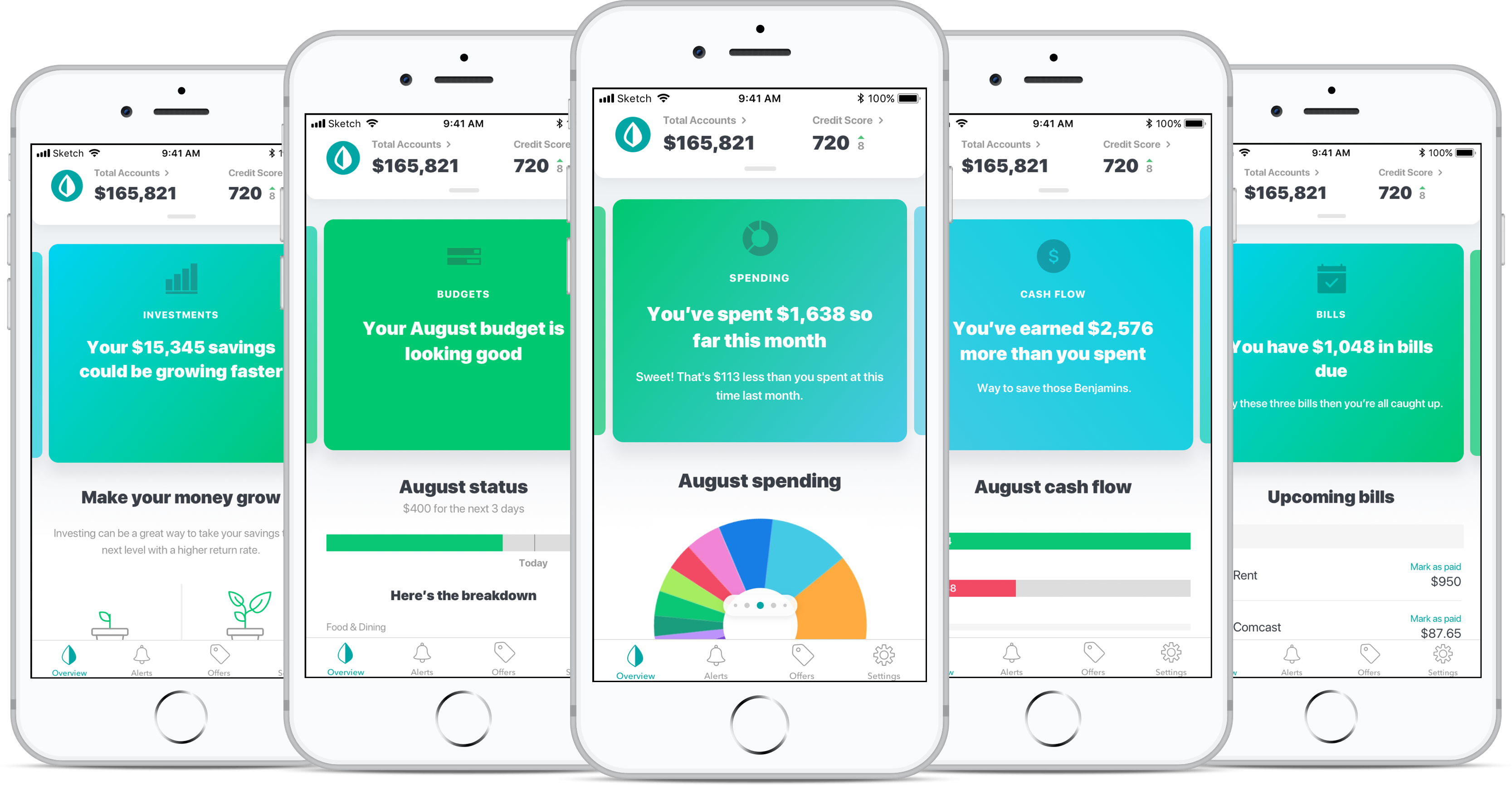

1. Mint:

Mint is a free budgeting app that allows you to link your bank and credit card accounts and see all your financial information in one place. It creates a budget for you based on your spending habits and tracks your progress towards your financial goals.

Pros: It’s free, easy to use, and offers a wide range of features.

Cons: It may not be as customizable as some other budgeting apps.

Try Mint

2. YNAB (You Need a Budget):

YNAB is a budgeting app that follows the principle of “giving every dollar a job,” helping you create a budget by assigning specific categories to your spending. It also includes a feature for tracking shared expenses between couples and offers financial education resources.

Pros: The budgeting method is highly effective for some users, and the app includes a lot of helpful resources and support.

Cons: It is a paid app, with a subscription fee of $11.99 per month or $84 per year.

Try YNAB

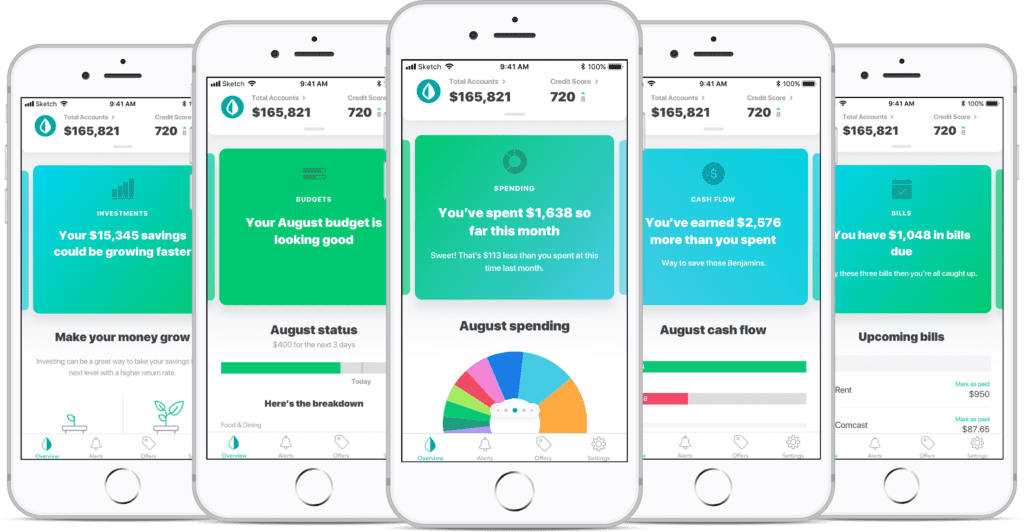

3. Pocketbook:

Pocketbook is a budgeting app that allows you to track your spending and create a budget by linking your bank and credit card accounts. It also has a feature for tracking shared expenses and creating a budget together as a couple.

Pros: It’s free and easy to use, with a clean interface and helpful alerts and notifications.

Cons: Some users have reported issues with the accuracy of the budgeting and expense tracking features.

Try Pocketbook

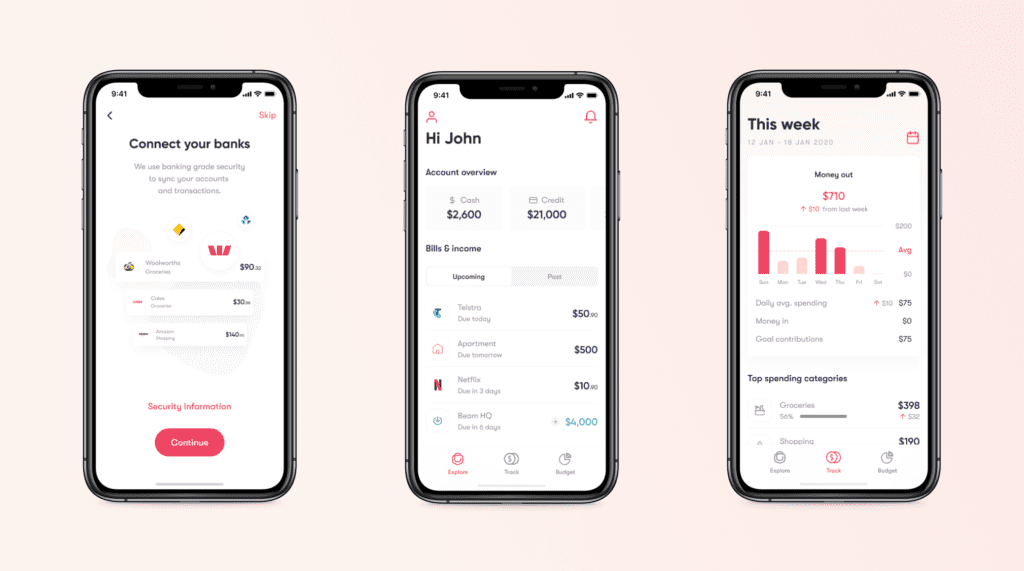

4. Spendee:

Spendee is a budgeting app that allows you to track your spending and create a budget by linking your bank and credit card accounts. It also has a feature for sharing expenses with a partner and creating a joint budget.

Pros: It has a user-friendly interface and offers a wide range of features, including the ability to track expenses in multiple currencies.

Cons: It is a paid app, with a subscription fee starting at $3.99 per month.

Try Spendee

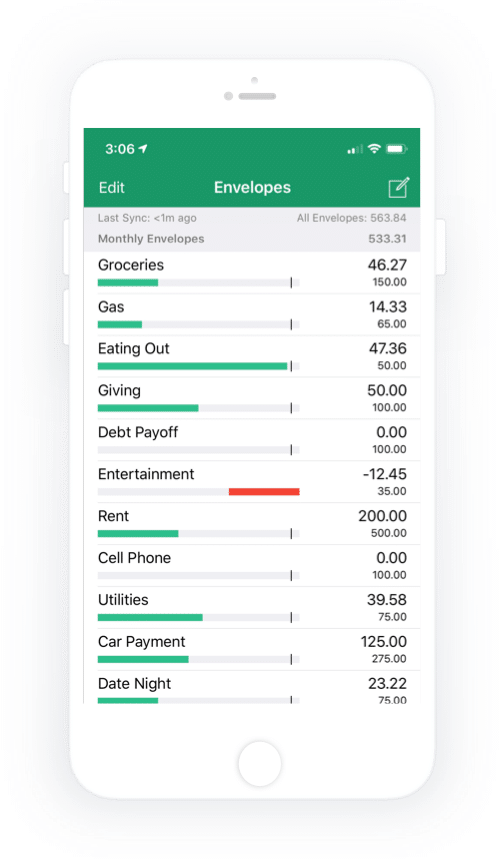

5. Goodbudget:

Goodbudget is a budgeting app that uses the envelope budgeting method, where you assign a specific amount of money to different categories and track your spending within those categories. It also has a feature for sharing expenses with a partner and creating a joint budget.

Pros: The envelope budgeting method can be effective for some users, and the app offers a wide range of features.

Cons: It is a paid app, with a subscription fee starting at $7 per month. Some users have also reported difficulty using the app on multiple devices.

Try Goodbudget

It’s important to find an app that works for you and your partner, and to communicate openly about your budget and financial goals. It may also be helpful to try out a few different apps to see which one works best for your needs. If you enjoyed this list, check out our top investing apps for beginners!

Conclusion

Budgeting apps can be helpful in a number of ways:

- They make it easier to track your spending: Budgeting apps allow you to link your bank and credit card accounts, so you can see all your financial transactions in one place. This makes it easier to see where your money is going and how you are tracking against your budget.

- They provide alerts and notifications: Many budgeting apps offer alerts and notifications when you are approaching or over your budget in a particular category, or when bills are due. This can help you to stay on track with your budget and avoid overspending.

- They offer a range of features: Budgeting apps often include a range of features, such as the ability to create and track a budget, set financial goals, and track shared expenses with a partner. This can make it easier to manage your finances and achieve your financial goals.

- They can be accessed on the go: Budgeting apps can be accessed from your phone or other device, so you can track your spending and manage your budget wherever you are. This can be especially helpful for people who are always on the go.

Overall, budgeting apps can be a useful tool for helping you to track your spending, stay on top of your budget, and achieve your financial goals.