Congratulations on starting your college journey! You’re about to embark on a new phase of life that will be full of exciting opportunities and challenges.

As a college freshman, it’s essential to learn how to manage your finances effectively. Now that you have moved out on your own you’ll need to learn how to budget your money so that you don’t run out of cash before the semester ends. In this article, we’ll show you how to budget as a college freshman.

Create a Budget Plan

The first step in budgeting is to create a budget plan. Start by listing all your sources of income, including financial aid, scholarships, part-time jobs, or any other source of income.

Next, make a list of all your expenses, including tuition, room and board, textbooks, transportation, food, and entertainment. It’s essential to be realistic about your expenses so that you can create a budget that you can stick to.

It may take you a few weeks, or months to have a good idea on what your expenses will look like, so it is important to be on top of your budget planning and update your budget accordingly.

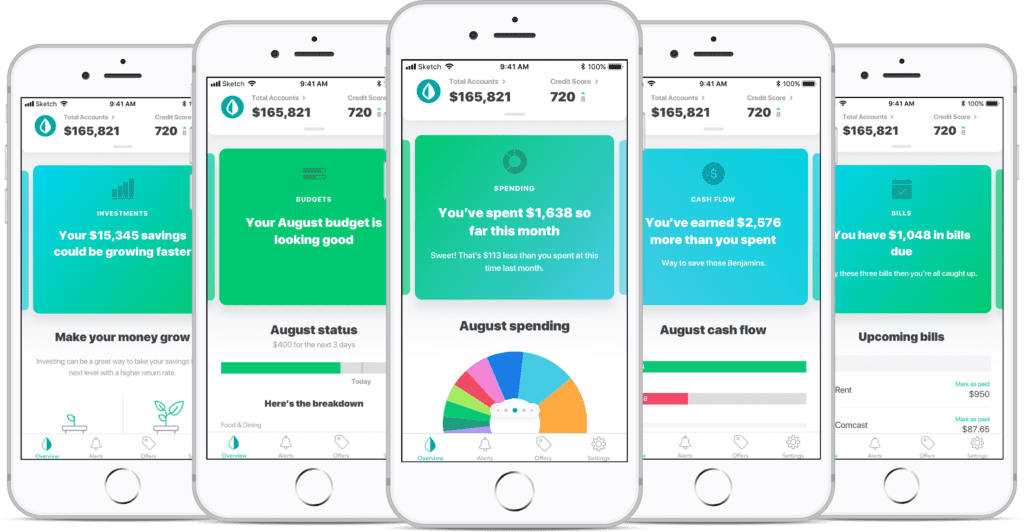

There are many apps to help you budget, but my two favorites are Rocket Money, and Mint.

Categorize Your Expenses

Once you’ve created a list of all your expenses, categorize them into fixed and variable expenses. Fixed expenses are those that remain constant each month, such as rent, tuition, or car payments. Variable expenses, on the other hand, fluctuate from month to month, such as groceries, entertainment, or clothing.

By categorizing your expenses, you can see which ones are necessary and which ones you can cut back on if you need to.

Main Expense Categories:

- Tuition and Fees: Your tuition and fees will likely be the largest expense that you will face as a college freshman. This category includes the cost of attending classes, paying for textbooks, and any other fees associated with attending your chosen college or university.

- Room and Board: This category includes the cost of your housing and meals. Whether you are living in a dormitory, renting an apartment, or staying with family, you will need to factor in the cost of rent, utilities, and groceries.

- Transportation: Depending on your location, transportation costs can add up quickly. You will need to consider the cost of gas, public transportation, or other means of getting around.

- Personal Expenses: This category includes all the little things that can add up quickly, such as clothing, entertainment, and personal care items like toiletries and hygiene products.

- Medical Expenses: Even if you are covered under your parents’ health insurance plan, there may be out-of-pocket costs that you will need to cover. You may also need to factor in the cost of prescription medications or any medical treatments that are not covered by insurance.

Track Your Spending

To ensure that you stick to your budget, it’s essential to track your spending. Keep a record of all your expenses, including small purchases like coffee or snacks. You can use an app, spreadsheet, or a simple pen and paper to track your spending. Review your spending regularly to ensure that you’re sticking to your budget plan.

Look for Ways to Save Money

There are many ways to save money as a college freshman. Look for deals on textbooks, consider buying used books, or rent your books from somewhere like Amazon. If you do not already own a car, or your college campus charges a lot for parking, try to use public transportation or carpool with friends instead of owning a car during your first semester. This will give you a good idea on whether or not you will need your car at school.

Another huge way to save money is to keep track of and cancel unused subscriptions. Go through all of your current subscriptions and really think about what is necessary. If you are not totally sure what subscriptions you have right now, you can use apps like Rocket Money, which will find, and even help you cancel unused subscriptions.

There are going to be many student discounts at restaurants, theaters, and other places. It may be difficult in a dorm, but you can save a ton of money by skipping eating out every day and cooking meals at home instead. These small changes can add up and help you save money.

Plan for Emergencies

It’s essential to plan for emergencies when creating a budget. Unexpected expenses can arise, such as a medical emergency or car repair. Consider setting up an emergency fund and contribute to it regularly. Having an emergency fund can help you avoid going into debt when unexpected expenses arise.

If you are working, consider using a cash envelope system to help budget your income.

Tips for Budgeting as a College Freshman

Use Budgeting apps to track your spending and income (if you are working)

My favorite is Mint as it is an excellent resource for budgeting as a college student. It is a free budgeting app that allows you to track your spending, create a budget plan, and set financial goals. You can link all your bank accounts, credit cards, and loans to Mint safely and securely, making it easy to see your finances in one place.

How much money do you need to move out?

Moving out can be expensive, especially as a college student. I have a whole article on how to budget for your move and much more.

Budgeting as a freshman in college can seem daunting, but with careful planning and smart money management, you can set yourself up for financial success throughout your college years and beyond. Remember to create a budget, track your expenses, look for ways to save money, and prioritize your spending to ensure that you’re meeting your financial goals. By following these tips and utilizing the resources available to you, you can make the most of your college experience without breaking the bank.

Should I get a job while attending college?

Getting a job while attending college can be a great way to earn some extra income and gain valuable work experience. However, it’s important to balance your work and study commitments and ensure that your job doesn’t interfere with your academic performance.

How much money should I budget for college expenses?

The amount of money you’ll need to budget for college expenses will depend on a variety of factors, including the cost of tuition, room and board, textbooks, transportation, and personal expenses. It’s a good idea to create a detailed budget and track your expenses to ensure that you’re not overspending.

Can I save money on textbooks?

Yes, there are many ways to save money on textbooks, including buying used or renting textbooks, purchasing e-books, and utilizing library resources. You should also consider buying textbooks online or searching for discounts and deals. Amazon actually has excellent deals on used books, as well as book rentals.