A critical first step toward achieving financial security and independence is saving money. Breaking the loop of excessive spending and adhering to a budget might be difficult, but with a little ingenuity and willpower, you can create habits that will enable you to save more money and reach your financial objectives. The top five money-saving challenges are listed below.

1. The 30-Day No Spend Challenge

An excellent approach to start saving money is with the 30-Day No Spend Challenge. You’ll pledge not to make any unneeded purchases for a period of 30 days. This entails forgoing eating out, buying coffee, and shopping for luxuries. The goal of the challenge is to make you more aware of your spending patterns and help you spot areas where you may make savings. Consider keeping a spending log for the duration of the challenge to determine exactly how much you are saving. This will help the challenge be even more successful.

You can stop the habit of impulsive spending thanks to the 30-Day No Spend Challenge, which is one of its main advantages. When forced to choose between two unneeded purchases, you’ll be more inclined to pause and decide whether the item is truly worth the money. Additionally, the challenge is a fantastic chance to get inventive and discover fresh, affordable pastimes, like throwing a potluck dinner or going on a hike.

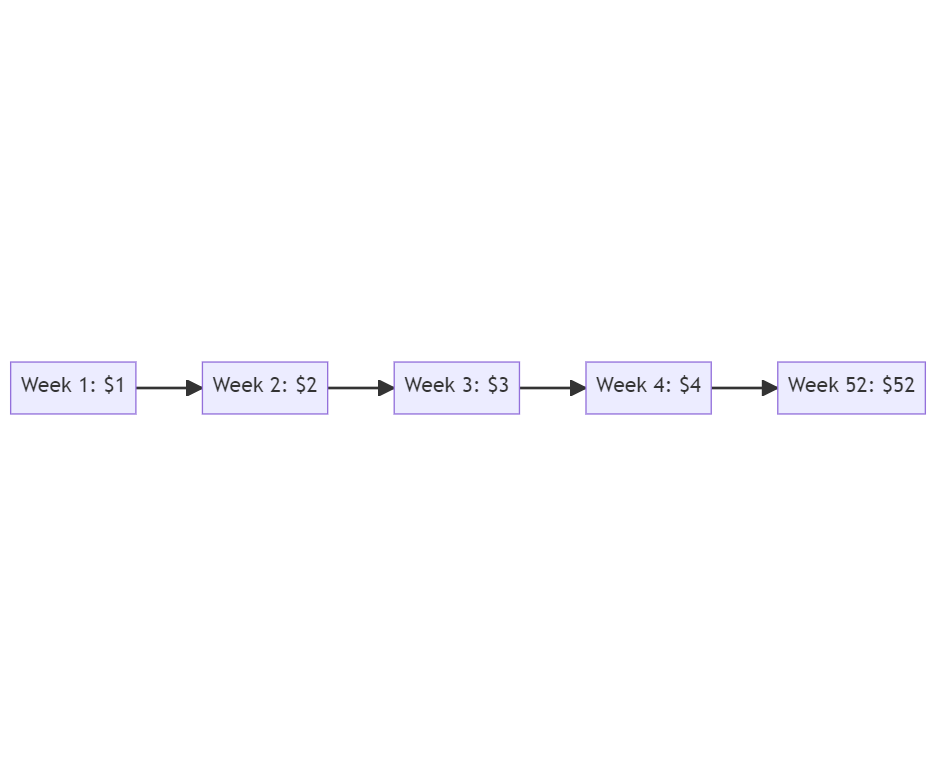

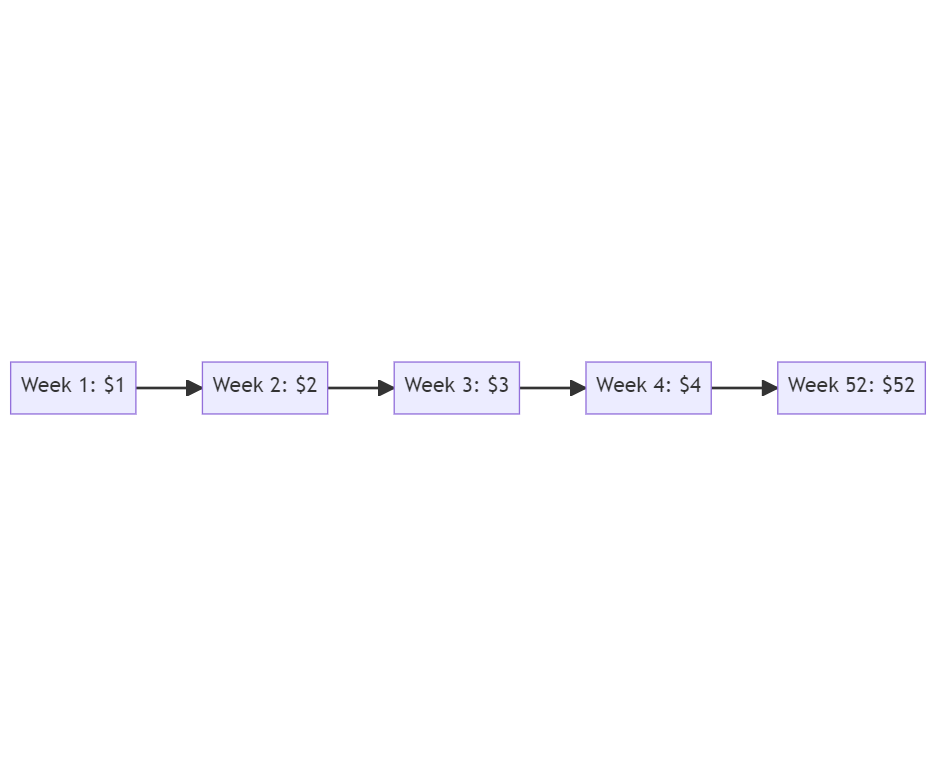

2. The 52-Week Money Challenge

The 52-Week Money Challenge is a gradual savings plan that requires you to save a little bit more each week. The concept is straightforward: begin by setting aside $1 in week one, then $2 in week two, and so on, up until you have $52 saved by week 52. By year’s end, you’ll have amassed nearly $1,300 in savings.

Starting to save money through the challenge is a great method to do so without being overwhelmed. Your surplus funds can be used to pay off debt, finance an emergency fund, or put money down for a down payment on a house. It’s a fantastic approach to instill in kids the value of setting financial goals and conserving money.

To take part in the 52-Week Money Challenge, you must open a savings account and make consistent weekly deposits. So that you don’t have to think about saving, think about automating it. Other innovative ways to save money throughout the year include reducing your monthly spending or selling stuff you no longer use.

3. The No Eating Out Challenge

For many families, eating out is one of the biggest expenses. By preparing all of your meals at home and eschewing restaurants, fast food, and takeaway, you can complete the No Eating Out Challenge. This challenge is a great way to broaden your culinary knowledge, save money, and get better at cooking.

You must prepare your meals in advance and create a grocery list if you want to take part in the No Eating Out Challenge. For a wide range of dinner options, think about stocking your pantry with essentials like rice, pasta, and canned foods. You can also find ideas for tasty, inexpensive meals for the whole family online or in cookbooks.

You may save hundreds of dollars each month and enhance your health by taking the No Eating Out Challenge. Meals prepared at home are often healthier and less expensive than meals ordered from restaurants.

4. The $5 Savings Plan

The $5 Savings Plan is a quick and easy method to start saving money. Put $5 bills into a designated savings jar each time you get one. This modest activity over time will quickly pile up and assist you in achieving your financial objectives.

Keep the savings container in a prominent spot, such as on your kitchen counter or in your wallet, to make the most of this challenge. This makes it easier for you to keep in mind to add your $5 bill each time you get one. Set a savings objective as well, perhaps for a car down payment or a vacation fund. A clear objective in mind can keep you motivated and on course.

5. The No Shopping Challenge

The No Purchasing Challenge entails refraining from any shopping for a predetermined amount of time, such 30 or 60 days, including online shopping. You can concentrate on your financial objectives and kick the impulse buying habit by taking on this challenge. Instead of shopping I recommend doing the opposite and selling your used clothes!

You can actually change your financial future by taking part in money-saving activities. You can achieve your financial objectives and improve your spending and saving habits with their assistance. Start now to create a more promising financial future!

6. The Cash Envelope System

The Cash Envelope System is a budgeting technique that calls for paying for some expenses with cash rather than credit or debit cards. Make envelopes for different expenditure categories, such as dining out, entertainment, and other expenses. Put the money allotted for that category in each envelope, and only use that money for that category. This aids in keeping you on budget and preventing overpaying.

Prioritize your spending by starting with the most crucial costs, such as rent and groceries, to get the most of this challenge. After that, divide up your remaining funds among different uses, like savings or recreation. Use only the cash in the envelopes and be aware of your expenditures; refrain from using credit or debit cards.

I have written a whole article on the Cash Envelope System, if it is something you are interested I suggest checking it out!

7. The No New Clothes Challenge

The cost of buying clothing can quickly build up and affect your budget. The No New Clothes Challenge is a fantastic method to cut down on this cost and improve your awareness of your buying patterns. For a set period of time, such as a month or a year, refrain from purchasing new apparel and concentrate on wearing what you already have.

Organize your wardrobe and prepare clothing plans ahead of time to get the most out of this challenge. If you want to give something you currently own a new look, think about fixing or changing it. You may save money and concentrate on creating a more sustainable wardrobe by avoiding impulsive purchases.

How to Save $1,000

Although saving $1,000 may seem like a difficult endeavor, it is achievable with a few adjustments to your spending patterns and financial plan. Here are some pointers to get you going:

- Create a budget: This is the first and most important step in saving money. To find where your money is going and where you might make savings, keep track of your income and expenses.

- Reduce unnecessary expenses: Identify areas where you can cut back on spending, such as eating out, entertainment, or subscriptions you don’t use.

- Increase your income: Look for ways to increase your income, such as taking on a side job or selling items you no longer need.

- Automate your savings: Set up automatic transfers from your checking account to your savings account to make saving a habit.

- Track your progress: Review your progress frequently and make necessary adjustments to your spending plan. Being able to see your progress can inspire you to keep going.

You may save $1,000 and improve your financial status overall by implementing the advice in this article. Keep in mind that it could take some time to reach your objective, but you can do it if you are persistent and committed.

Money Savings Journey

You may improve your financial status and form healthier spending habits by taking on these money-saving challenges.

These challenges can help you achieve your goals, regardless of whether you’re saving for a particular objective or simply trying to increase your financial security. Select the challenge that most closely matches your lifestyle, then begin right away!

Frequently Asked Questions

Do I need to complete all of the challenges at once?

No, you can pick a single challenge or a mix of challenges that fit your needs and your budget the best. It’s crucial to begin slowly and build up as you become used to the changes.

Can I still go out and have fun while participating in these challenges?

Yes, of course you can still have fun while participating in these challenges. When having fun, consider alternative, budget-friendly options such as picnics in the park, movie nights at home, or DIY projects.

What if I have a difficult time sticking to the challenge?

It’s normal to face obstacles while trying to change your spending habits. Consider enlisting the help of a friend or family member, or tracking your expenses to stay accountable. Remember to be kind to yourself and keep trying, it takes time to develop new habits.

Can these challenges help me reach my long-term financial goals?

Yes, by participating in these challenges, you can learn to live within your means, reduce your expenses, and save more money. These habits can help you reach your long-term financial goals, such as buying a home or saving for retirement.

Can these challenges be adapted for families?

Yes, these challenges can easily be adapted for families. Consider setting a challenge for the whole family to participate in and make it a fun, educational experience for everyone.