Deciding where to invest your money can be a challenging task, as there are many different options to consider and it’s important to choose investments that align with your financial goals and risk tolerance.

Steps to take when deciding where to invest your money:

1. Determine your financial goals:

The first step in deciding where to invest your money is to determine what you are trying to achieve. Do you want to save for retirement, buy a house, or have financial security in case of unexpected expenses?

Knowing your financial goals will help you determine the best investment strategy for you.

2. Assess your risk tolerance:

Different investments carry different levels of risk. It’s important to assess your risk tolerance to determine which investments are right for you.

If you are willing to take on more risk, you may want to consider investments with the potential for higher returns, such as stocks or real estate. If you are risk-averse, you may want to consider investments with lower risk, such as bonds or certificates of deposit (CDs).

3. Consider your time horizon:

How long do you plan to invest your money? If you have a long time horizon, you may be able to afford to take on more risk, as you have more time to weather market fluctuations.

If you have a shorter time horizon, you may want to consider investments with lower risk and more stability.

4. Research your options:

Once you have a good understanding of your financial goals, risk tolerance, and time horizon, you can start researching different investment options.

Look for investments that align with your goals and risk tolerance and consider factors such as fees, past performance, and reputation.

5. Diversify your portfolio:

It’s generally a good idea to diversify your portfolio by investing in a mix of different asset classes, such as stocks, bonds, and cash.

This can help reduce the overall risk of your portfolio and increase your chances of success.

Remember, investing carries risks and it’s important to do your research and understand the potential risks and rewards of each investment before making a decision.

It may also be a good idea to consult with a financial advisor or professional to help you make informed investment decisions.

5 Best Investment Apps for Beginners

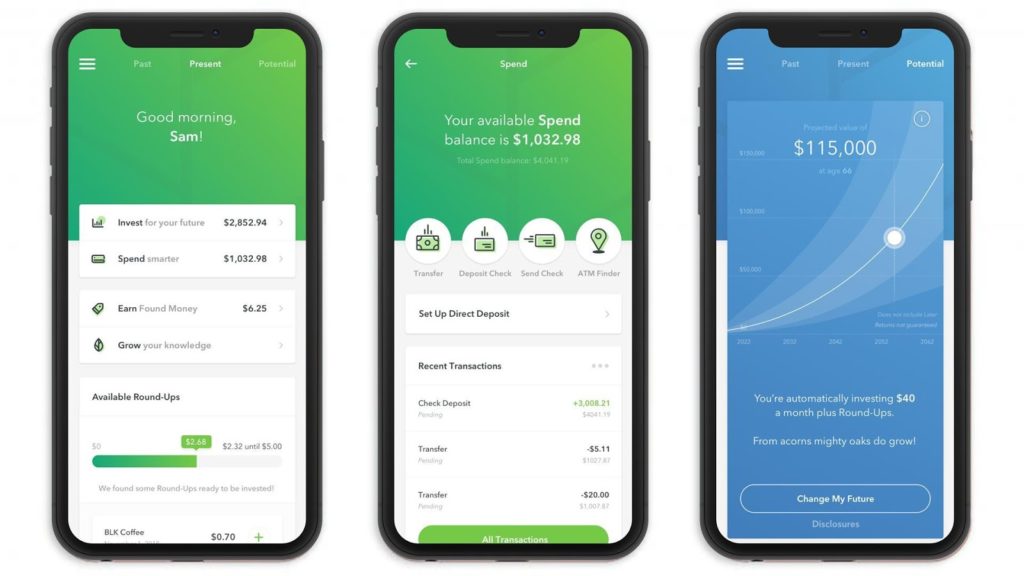

1. Acorns:

Acorns app helps beginners invest their spare change by rounding up everyday purchases and investing the difference into a diversified portfolio of exchange-traded funds (ETFs). It offers a variety of investment portfolios to choose from, including a socially responsible portfolio and a high-yield savings account.

Pros:

- Easy to use and suitable for beginners

- Offers a variety of investment portfolios to choose from

- Provides educational resources to help users understand investing

Cons:

- Has relatively high fees compared to some other investing apps

- Limited investment options (only ETFs)

Try Acorns

2. Robinhood:

Robinhood allows users to buy and sell stocks, ETFs, and options commission-free. It also has a feature called “Robinhood Snacks” that provides short, easy-to-understand summaries of business and finance news.

Pros:

- Commission-free trading

- Wide range of investment options (stocks, ETFs, options)

- Educational resources and news summaries

Cons:

- Limited in terms of financial planning and portfolio management tools

- Has faced controversy over its business practices, including its handling of user orders and failure to disclose conflicts of interest

Try Robinhood

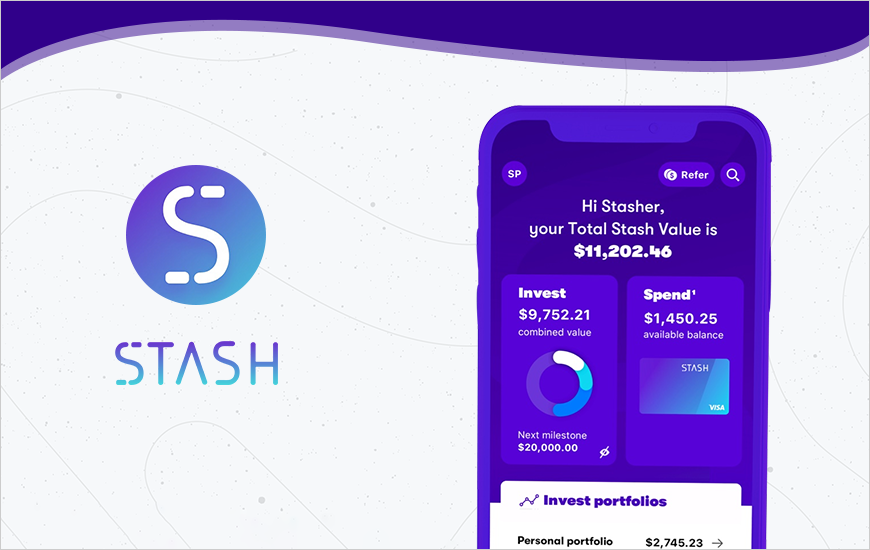

3. Stash:

Stash also allows users to invest in a variety of stocks and ETFs with as little as $1. It also offers educational resources to help beginners understand the stock market and make informed investment decisions.

Pros:

- Easy to use and suitable for beginners

- Wide range of investment options (stocks, ETFs)

- Offers educational resources and personalized recommendations

Cons:

- Has relatively high fees compared to some other investing apps

- Limited in terms of financial planning and portfolio management tools

Try Stash

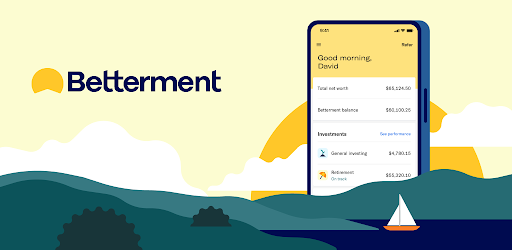

4. Betterment:

Betterment is a bit different than the others we have listed as it provides personalized investment recommendations based on users’ financial goals and risk tolerance. It also offers financial planning tools, such as a retirement calculator and a goal tracker.

Pros:

- Personalized investment recommendations

- Wide range of financial planning tools

- Offers both taxable and retirement accounts

Cons:

- Has relatively high fees compared to some other investing apps

- Limited in terms of investment options (only ETFs)

Try Betterment

Wealthfront uses modern portfolio theory to create diversified investment portfolios for its users. It also offers a variety of financial planning tools, including a retirement planner and a college savings calculator.

5. Wealthfront:

Pros:

- Offers a range of financial planning tools

- Uses modern portfolio theory to create diversified portfolios

- Offers both taxable and retirement accounts

Cons:

- Has relatively high fees compared to some other investing apps

- Limited in terms of investment options (only ETFs)

Try Wealthfront

Importance of Investing

Investing your money can help you achieve your long-term financial goals, such as saving for retirement or building wealth. Investing can also provide a way to diversify your portfolio and potentially earn higher returns than those offered by traditional savings accounts or certificates of deposit (CDs).

By investing, you can potentially earn a return on your money that outpaces inflation, allowing your money to maintain its purchasing power over time.

Investing can also be a way to align your values with your investments, as there are a variety of investment options available, including socially responsible investments and environmentally sustainable investments.

It’s important to note that investing carries some level of risk, as the value of your investments can fluctuate due to changes in the market. It’s important to carefully consider your risk tolerance and financial goals before making any investment decisions.

Just as important as investing, is saving your money, if you want tips on how to create an emergency fund, check out our article building one.

Conclusion

No matter which app or platform you use, you are already taking positive steps towards your financial goals. Don’t be discouraged if you try one of these apps and it is not for you, feel free to diversify (even in the platforms you use) with your investments.